- JPY call demand hit a two-month low on Thursday, risk reversals indicate

- The risk reversal adds credence to the bullish technical setup seen in the USD/JPY chart.

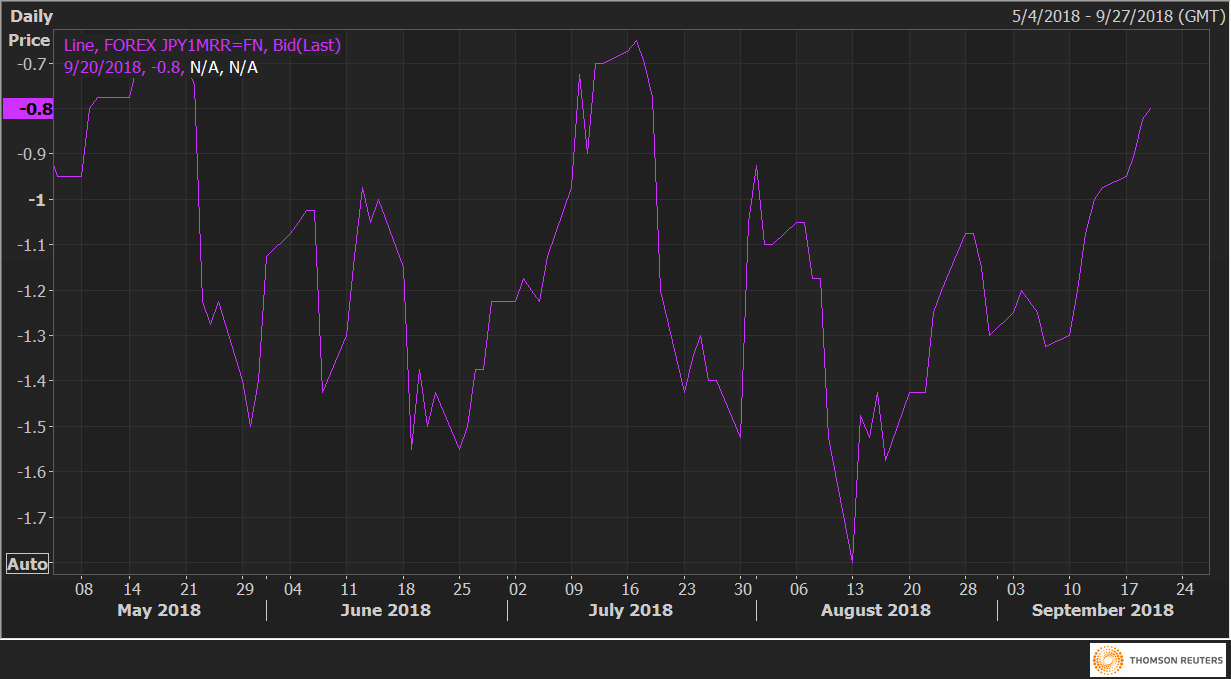

Currently, the USD/JPY one-month 25 delta risk reversals (JPY1MRR) are being paid at -0.80 – the highest level since July 19 – indicating the implied volatility premium or the demand for JPY calls is at the lowest level in two months.

The negative number shows the implied volatility premium or the demand for JPY calls is higher than that of JPY puts.

The falling demand for JPY calls (bullish bets) validates the case for a re-test of the yearly highs above 113.00 put forward by the bullish technical setup: higher lows, bull flag breakout and the ascending 5, 10-day moving averages.

JPY1MRR