- USD/JPY risk reversals hit a one-month low, shows rising demand for JPY calls.

- Indicates investors are prepping for a deeper pullback in the USD/JPY.

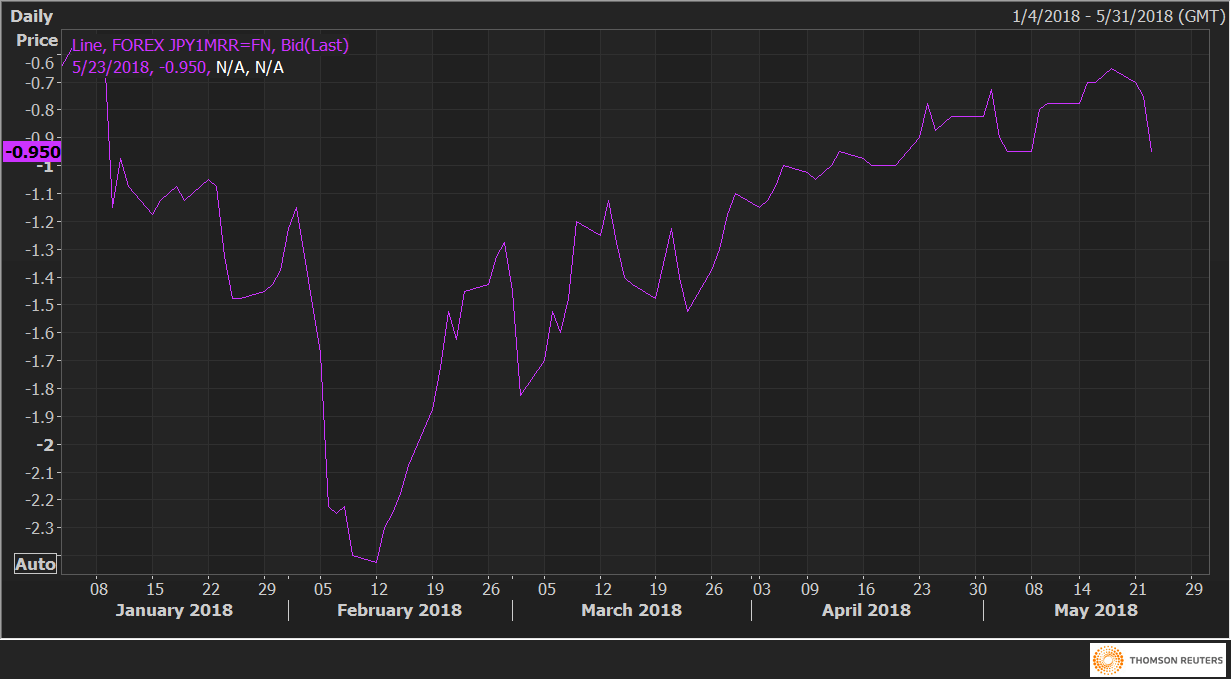

The USD/JPY one month 25 delta risk reversals (JPY1MRR) fell to -0.95 – the lowest level since April 20 vs -0.65 on April 18.

The decline in the risk reversals represents a rise in the implied volatility premium for the Japanese Yen calls (bullish bets).

The risk reversals add credence to the drop in the USD/JPY pair from 111.40 to 110.42 and indicate investors could be hedging (via JPY calls) against a deeper drop in the spot.

JPY1MRR