- USD/JPY unnerved by the Fed and markets remains on a firm footing.

- USD/JPY holds at the intraday support around the 50% retracement of its January rally.

USD/JPY probed 109.25 then dipped to 109.00 overnight and has been steady ever since on a day where a steady hand from the Federal Reserve stabilised markets. At the time of writing, USD/JPY sits at 109.05, slightly up from the early Asia ow of 108.97.

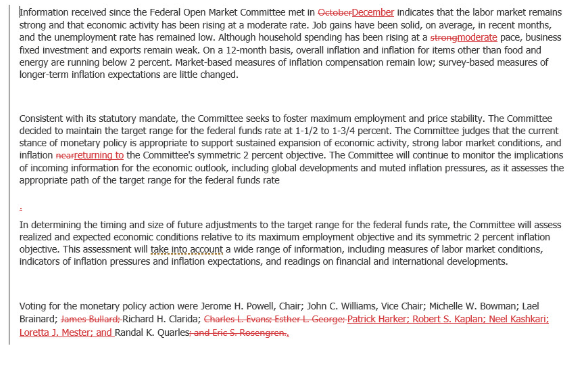

Markets were expecting the Fed to keep its main policy rate unchanged with a target range of 1.50%-1.75%. The decision was unanimous (10-0), as was December’s. Indeed, the central bank repeated its guidance from the December meeting. The Fed is watchful of “incoming data including Global developments in muted inflation pressures.” The most dovish thing that Governor Jerome Powell said in the presser was how uncomfortable he is with inflation persistently below 2%. The statement was almost identical to December:

Changes to statement

As can be seen, there were some minor narrative tweaks: policy is deemed appropriate to support “inflation returning to the committee’s symmetric 2% objective” (vs supporting inflation “near” the 2% objective). It downgraded its assessment of household spending to “moderate” (vs “strong”).

FOMC keeps rates unchanged

- Target rate remains at 1.5% to 1.75%.

- Interest rate on excess reserves 1.6% versus 1.55%.

- The decision is unanimous.

- Fed says labor market stronger, economy rising at moderate rate.

- Consumption moderate, investment and exports week.

- Job gains solid, unemployment has remained a low.

- Overall and core inflation running below 2%.

- Fed leaves discount rate at 2.25%.

- Market-based gauges of inflation compensation remain low.

- Aims for inflation returning to symmetric 2% goal.

- Reiterates plan to buy treasury bills into 2nd half of 2020.

- Continue to conducting Terman overnight repo operations at least through April.

- Survey based inflation expectations a little changed.

- Current policy appropriate to sustain expansion.

- Will continue to monitor incoming data including Global developments in muted inflation pressures.

As for Powell, there was a dovish hint:

-

Powell speech: Fed is not satisfied with inflation running below 2% and it is not a ceiling

- Although, prior: Powell speech: Fed expects inflation to move closer to 2% over the next few months

Consequently, the US two-year treasury yields fell from 1.46% in Asian trade to 1.41% post-FOMC, 10-year yields went from 1.66% to 1.58%. Meanwhile, the markets still price a 10% chance of a rate cut in March and a terminal rate of 1.14% (vs Fed’s mid-rate at 1.63% currently).

As for the coronavirus, China has confirmed 6,065 cases, with 132 deaths. There have been no reported deaths outside China thus far and markets are taking this in its stride.

USD/JPY levels

-

USD/JPY Forecast: Stable above 109.00

Valeria Bednarik, the Chief Analyst at FXStreet, explained that “the USD/JPY pair has found intraday support around the 50% retracement of its January rally in the 108.90 area, the immediate support” –

“The 4-hour chart shows that the pair briefly surpassed a bearish 20 SMA but returned below it, while technical indicators began to ease after entering positive territory, now heading south and reflecting the absence of buying interest. The pair would need to advance beyond 109.30, the 38.2% retracement of the mentioned rally, to be able to extend its recovery and approach the 110.00 figure.”