- USD/JPY meets a key support level with further run off to 61.8% Fib on the cards.

- US yields are softer and the greenback is following suit.

- Trade wars and COVID-19 are risks that will attract flows into both the dollar and yen.

USD/JPY is on the back foot, with the price sliding in New York in the 106.70s to a low of 106.41 so far. The dollar is weaker and US 10-year yields are sliding. The high on the day was 106.89, scored in the European session, but the Wall Street session’s move has just moved in to test the late April support structure.

The risk-off tones had supported a recovery in the US dollar with the DXY climbing back towards the 100 handle. This was following a sharp gap to the upside at the start of this month from the 98.60s which took the pair directly back onto the 99 handle. Trade wars, part-deux, between the US and China is fuelling the risk-off tones just as markets were looking for some bullish traction from nations seeking to get their economies back on track.

By relaxing the social distancing measures as COVID-19 new cases start to peak, investors had been hoping for some continuity to the upside in global stocks. However, if the looming risks of a second wave of COVID-19 contagion were not enough to keep uncertainty and volatility high, then the fresh escalation of US/China trade wars is sure to drive down risk appetite in the coming weeks ahead. More on that here: What you need to know as markets open: Pompeo and Trump ratcheted up US and China tensions

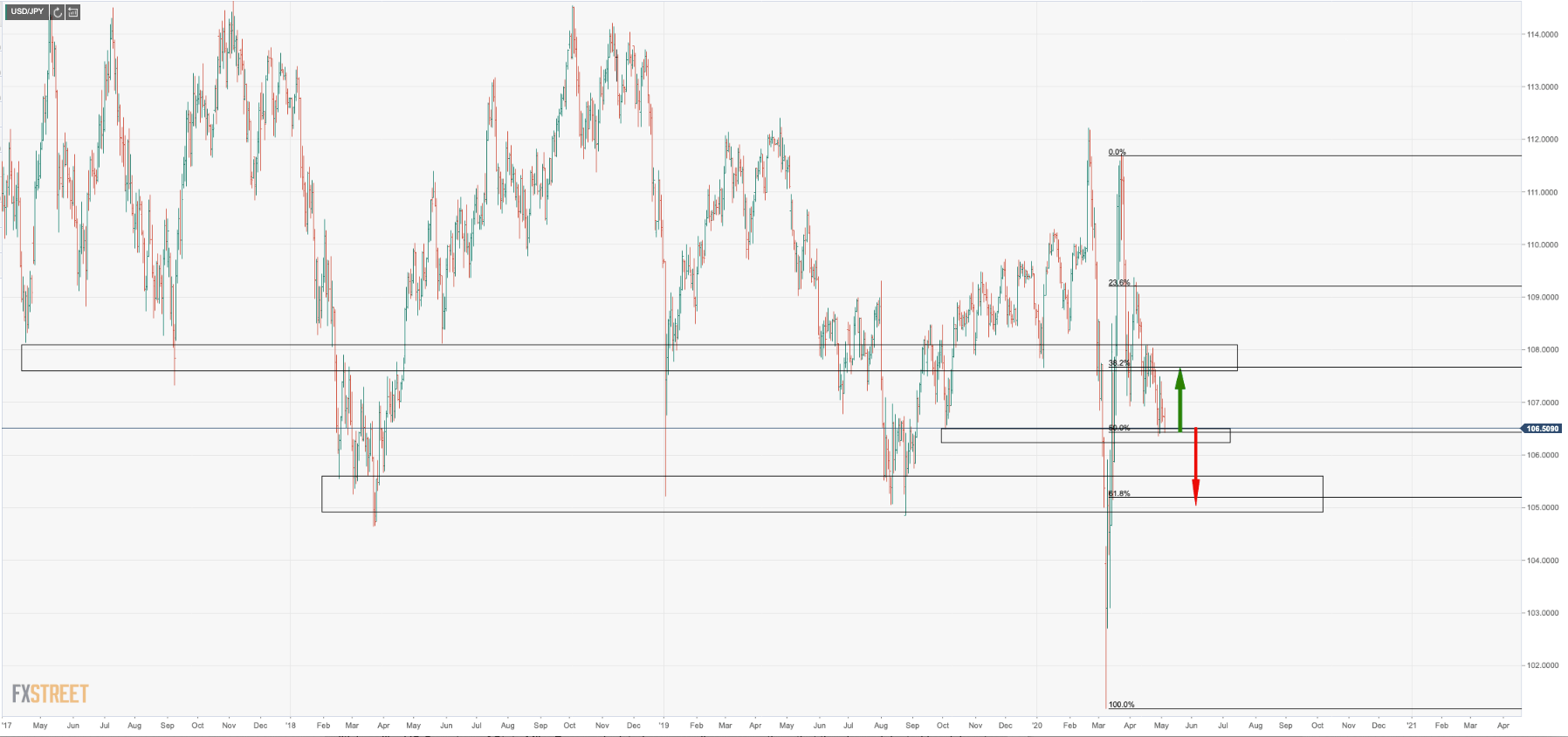

61.8% Fibo on the cards

Both the yen and the US dollar will, from time to time, enjoy their moments as the favoured go-to safe-haven currency. The road, in whichever direction, will, as usual, be a bumpy one for trend followers in this cross, especially at this technical juncture. USD/JPY is now testing a 50% mean reversion of the early-late March rally that means a support structure around 106.30/50. Trend followers will be looking for a test lower down of the August 2019 support area and a completion of a 61.8% Fibonacci target around 105 the figure. If this 50% marker holds, then there is an immediate risk to the upside before another push lower might come back on to the table.

USD/JPY levels