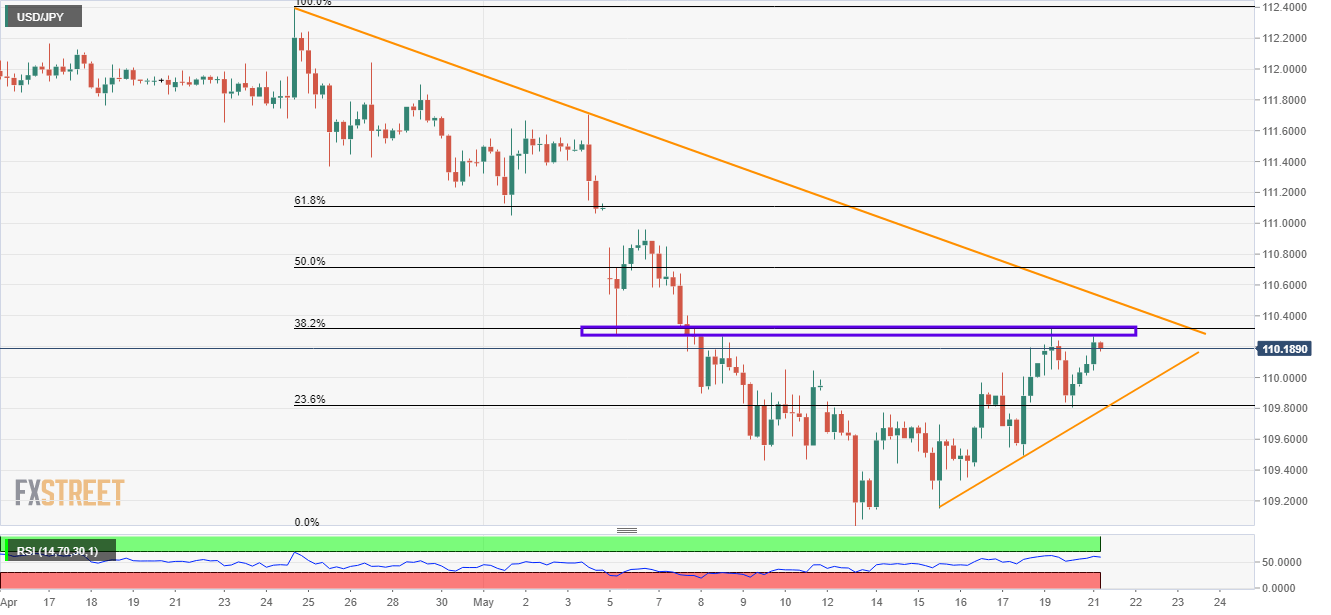

- Buyers rejected at immediate resistance-zone ahead of a trend-line barrier to the north.

- The steady increase from 109.00 portrays strength in upside momentum.

Gradual recovery from 109.00 seems struggling to clear immediate resistance area as USD/JPY trades near 110.20 ahead of Europe open on Tuesday.

Low of May 06 and highs marked afterward portray 110.30/35 as strong upside resistance for the pair near 38.2% Fibonacci retracement of its April to May downturn.

Should prices manage to clear 110.35 barriers, a run-up to descending trend-line stretched since April 24, at 110.55 can’t be denied.

Also, pair’s successful trade beyond 110.55 enables it to question 50% Fibonacci retracement level near 110.75 and 111.00 round-figure.

On the flipside, an upward sloping support-line from May 15 can limit the quote’s immediate declines near 109.80.

If sellers dominate past-109.80, 109.50 and 109.00 could come back to the charts.

USD/JPY 4-Hour chart

Trend: Pullback expected