- USD/JPY trades around 111.00 during initial Asian trading on Tuesday.

- The pair registered flash 2019 high on Monday and is positive so far during today.

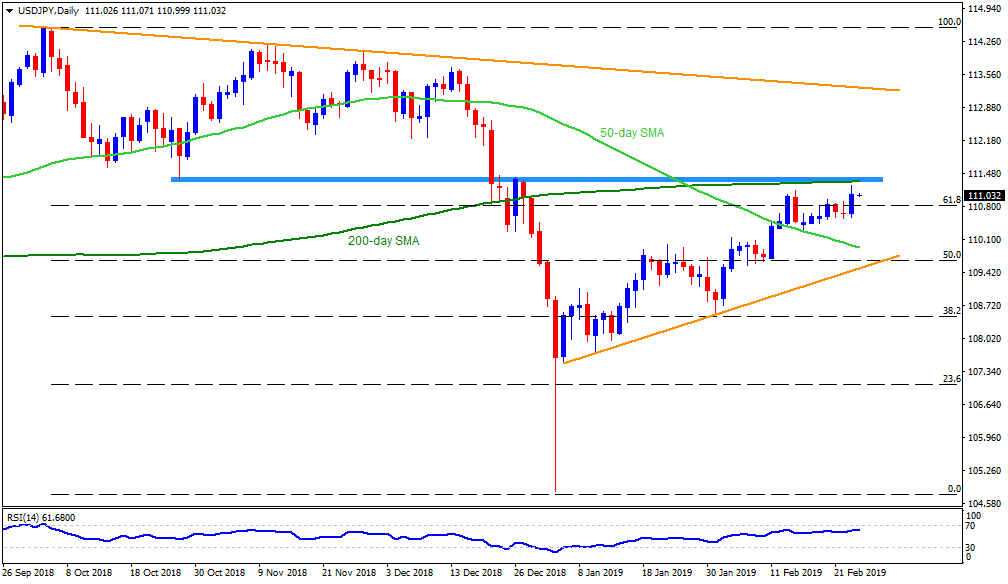

- The 14-day relative strength index (RSI) is gradually increasing and optimism surrounding the US-China trade deal may help the pair to extend its upside momentum.

- However, the 111.30/40 region, comprising 200-day simple moving average (SMA) and highs marked during late-December coupled with October lows, could become crucial resistance for the bulls to conquer.

- Should the pair crosses 111.40, 111.60 and 111.80 may offer intermediate halts ahead of visiting 112.00 round-figure.

- Additionally, pair’s extended rise over 112.00 might not hesitate to challenge 112.20 and 112.80 numbers to the north.

- Meanwhile, 110.90, 110.50 and 110.30 are likely nearby supports to follow during the pair’s pullback ahead of highlighting the 50-day SMA level of 109.90.

- In a case prices slide under 109.90, an upward sloping support-line stretched since early January, at 109.50, could become crucial to watch.

USD/JPY daily chart

Additional important levels:

Overview:

Today Last Price: 111.05

Today Daily change: 37 pips

Today Daily change %: 0.33%

Today Daily Open: 110.68

Trends:

Daily SMA20: 110.09

Daily SMA50: 109.9

Daily SMA100: 111.45

Daily SMA200: 111.31

Levels:

Previous Daily High: 110.91

Previous Daily Low: 110.55

Previous Weekly High: 110.96

Previous Weekly Low: 110.42

Previous Monthly High: 110

Previous Monthly Low: 104.75

Daily Fibonacci 38.2%: 110.69

Daily Fibonacci 61.8%: 110.77

Daily Pivot Point S1: 110.52

Daily Pivot Point S2: 110.36

Daily Pivot Point S3: 110.17

Daily Pivot Point R1: 110.87

Daily Pivot Point R2: 111.07

Daily Pivot Point R3: 111.23