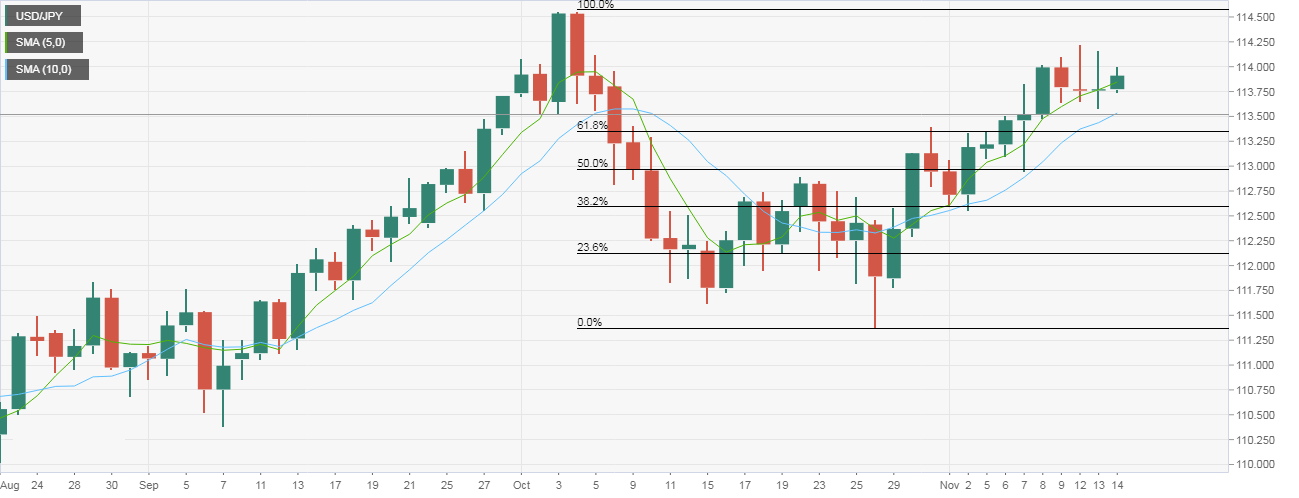

- The USD/JPY pair created doji candle on Monday and Tuesday, signaling indecision in the marketplace.

- A break above 114.23 (high of the Monday’s doji) would signal a resumption of the rally from the Oct. 26 low of 111.38 and would open up upside toward the recent high of 114.55.

- The 5-day and 10-day simple moving averages (SMAs) are trending north indicating a bullish setup. Further, the pair has found acceptance above 113.34 – 61.8% Fib R of 114.55/111.38. As a result, the pair is likely to cross 114.23 in favor of the bulls.

- A close below 113.58 (low of yesterday’s doji) would confirm a short-term bearish doji reversal, although prospects of a deeper drop would remain low as long as the pair is holding above the 10-day SMA.

Daily Chart

Trend: Neutral-to-bullish

USD/JPY

Overview:

Last Price: 113.94

Daily change: 17 pips

Daily change: 0.149%

Daily Open: 113.77

Trends:

Daily SMA20: 112.96

Daily SMA50: 112.68

Daily SMA100: 111.95

Daily SMA200: 110.08

Levels:

Daily High: 114.16

Daily Low: 113.58

Weekly High: 114.1

Weekly Low: 112.94

Monthly High: 114.56

Monthly Low: 111.38

Daily Fibonacci 38.2%: 113.94

Daily Fibonacci 61.8%: 113.8

Daily Pivot Point S1: 113.52

Daily Pivot Point S2: 113.26

Daily Pivot Point S3: 112.94

Daily Pivot Point R1: 114.1

Daily Pivot Point R2: 114.42

Daily Pivot Point R3: 114.68