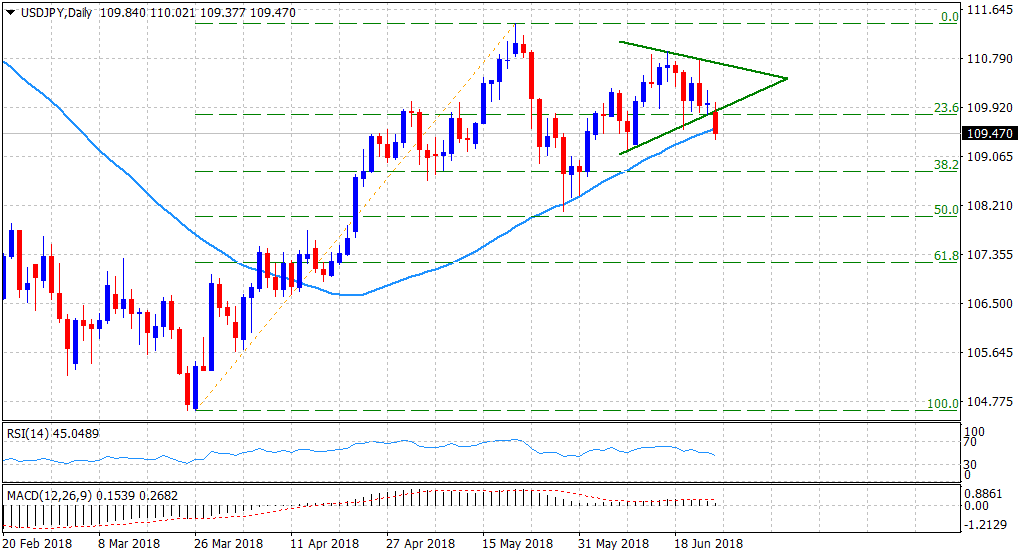

“¢ Finally breaks below a symmetrical triangular formation on the short-term chart and drops to test the lower end of a two-week-old trading range.

“¢ With short-term technical indicators gradually drifting into bearish territory, weakness below 50-day SMA support suggests further downside in the near-term.

“¢ Only a sustained move back above the very important 200-day SMA barrier might negate the anticipated bearish outlook.

Spot Rate: 109.47

Daily Low: 109.38

Daily High: 110.02

Trend: Bearish

Resistance

R1: 110.02 (current day high)

R2: 110.26 (200-day SMA)

R3: 110.44 (R2 daily pivot-point)

Support

S1: 109.20 (June 8 swing low)

S2: 109.00 (round figure mark)

S3: 108.21 (100-day SMA)