- The USD/JPY looks set to test the symmetrical triangle resistance of 114.08 and could move past that hurdle if Fed’s Q3 GDP indicates the economy is showing resilience in the face of rising overseas risks and Fed’s Powell boosts bets of an extended tightening cycle.

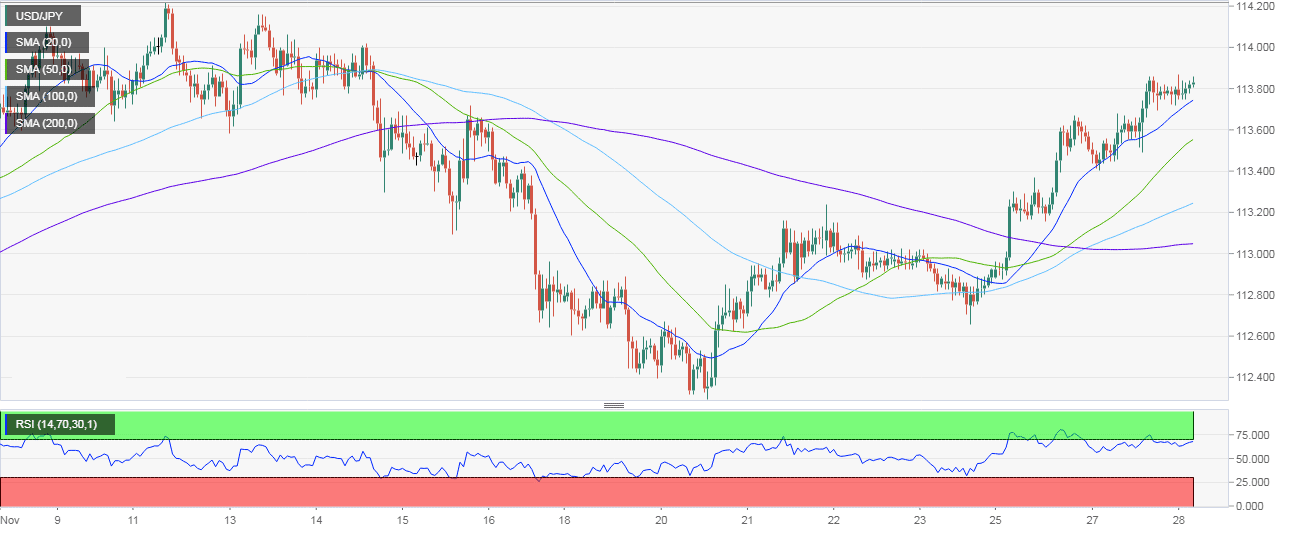

- The relative strength index on the hourly and 4-hour chart is signaling overbought conditions. The dips, if any, however, could be short-lived as the ascending 20-, 50-, 100-, and 200-hour moving averages (MAs) are trending north, indicating the path of least resistance is on the higher side.

- The dollar bulls need to watch out for a deeper pullback in the US 10-year yield, though, as the yield barely moved after hawkish comments from Fed’s Clarida and is struggling to move past the former-support-turned resistance of double top neckline of 3.057 percent.

Hourly Chart

Trend: Bullish

USD/JPY

Overview:

Today Last Price: 113.83

Today Daily change: 5.0 pips

Today Daily change %: 0.0439%

Today Daily Open: 113.78

Trends:

Previous Daily SMA20: 113.29

Previous Daily SMA50: 113

Previous Daily SMA100: 112.2

Previous Daily SMA200: 110.33

Levels:

Previous Daily High: 113.84

Previous Daily Low: 113.41

Previous Weekly High: 113.24

Previous Weekly Low: 112.3

Previous Monthly High: 114.56

Previous Monthly Low: 111.38

Previous Daily Fibonacci 38.2%: 113.68

Previous Daily Fibonacci 61.8%: 113.58

Previous Daily Pivot Point S1: 113.51

Previous Daily Pivot Point S2: 113.24

Previous Daily Pivot Point S3: 113.08

Previous Daily Pivot Point R1: 113.94

Previous Daily Pivot Point R2: 114.11

Previous Daily Pivot Point R3: 114.38