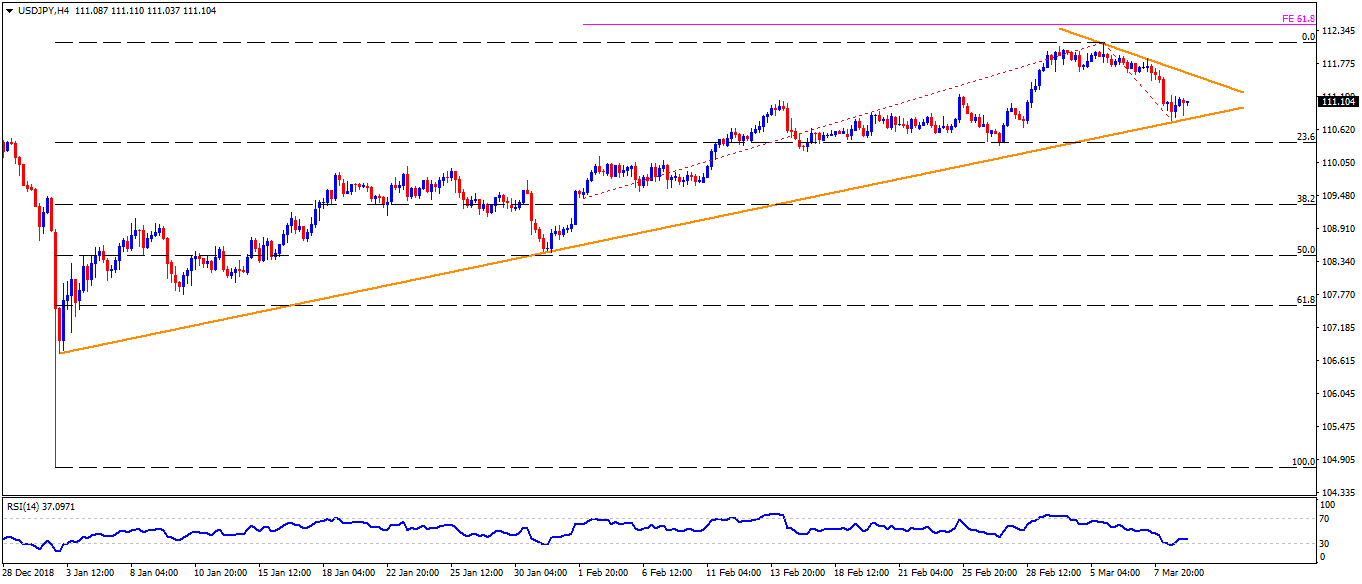

- USD/JPY is on bid around 111.00 during early Monday.

- The quote took a U-turn from nearly ten-week-old ascending support-line stretched since January 03 lows after flash crash.

- With this, buyers can aim for 111.60 on the break of 111.20 immediate resistance. However, a downward sloping trendline joining recent highs can challenge the pair’s upside then after.

- If at all prices rally beyond 111.60, 112.20 and 61.8% Fibonacci expansion (FE) of recent moves, at 112.50, can entertain bulls.

- Meanwhile, the downside break of 110.80 support-line highlights the importance of 23.6% Fibonacci retracement of January – March recovery, at 110.40.

- Additionally, pair’s extended declines under 110.40 might not refrain from recalling 110.00 and 109.60 on the chart.

USD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 111.1

Today Daily change: -3 pips

Today Daily change %: -0.03%

Today Daily Open: 111.13

Trends:

Daily SMA20: 111.02

Daily SMA50: 109.91

Daily SMA100: 111.35

Daily SMA200: 111.4

Levels:

Previous Daily High: 111.7

Previous Daily Low: 110.78

Previous Weekly High: 112.14

Previous Weekly Low: 110.78

Previous Monthly High: 111.5

Previous Monthly Low: 108.73

Daily Fibonacci 38.2%: 111.13

Daily Fibonacci 61.8%: 111.35

Daily Pivot Point S1: 110.7

Daily Pivot Point S2: 110.28

Daily Pivot Point S3: 109.78

Daily Pivot Point R1: 111.63

Daily Pivot Point R2: 112.13

Daily Pivot Point R3: 112.56