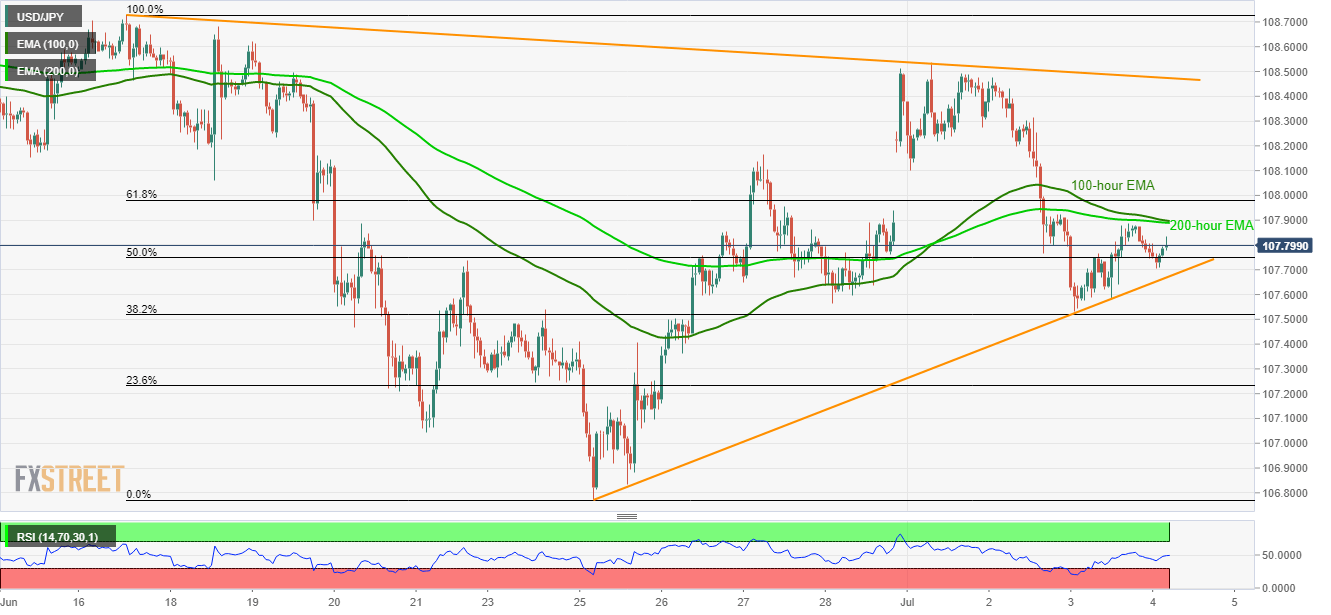

- The 100/200 hour EMA confluence to challenge the USD/JPY pair’s 9-day old recovery.

- Gradually increasing RSI supports latest up-moves.

Having reversed from the short-term ascending support-line, USD/JPY aims to confront the key resistance as it takes the bids near 107.81 while heading into Europe open on Thursday.

100 and 200 exponential moving averages (EMAs) on the hourly chart portray the importance of 107.89/90 resistance-confluence, a break of which can propel the prices up towards June 27 high of 108.17.

Should there be increase upside beyond 108.17, a 2-week long descending resistance-line at 108.47, followed by mid-June top surrounding 108.75/80 can limit the pair’s additional rise.

During the pullback, the aforementioned support-line at 107.67 should be followed closely as a break of which could recall 107.50 to the chart.

Furthermore, pair’s further declines below 107.50 can avail 107.30 and 107.10 as an intermediate halt during their slump to 106.78.

It should also be noted that 14-bar relative strength index (RSI) has been rising off-late, portraying the latest rise, but may reach overbought conditions soon around the key upside barrier.

USD/JPY hourly chart

Trend: Pullback expected