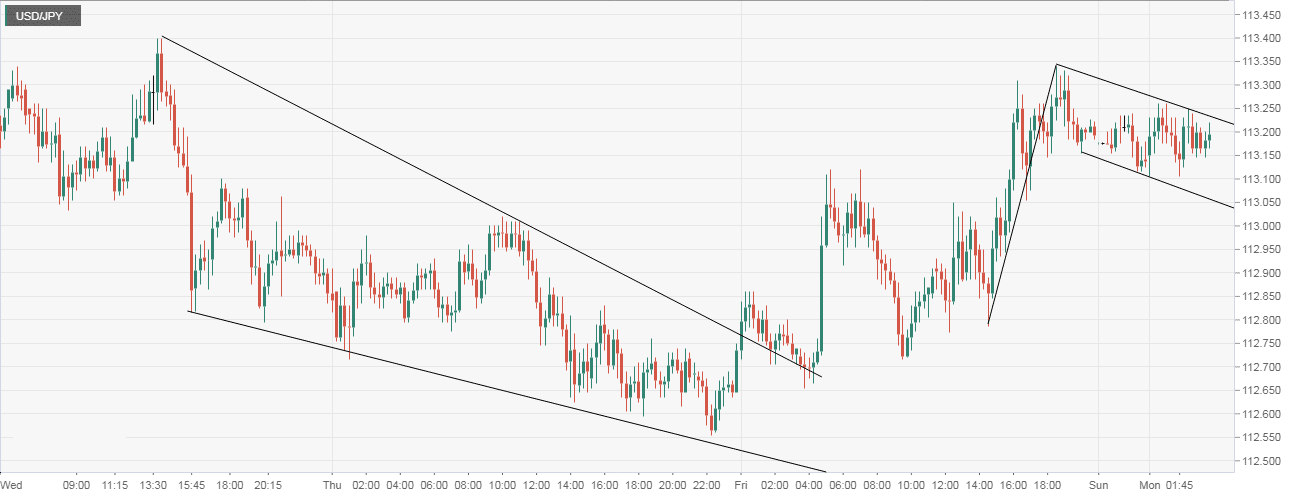

- The USD/JPY pair has created a bull flag pattern on the 15-min chart. It is a bullish continuation pattern, which means an upside breakout would imply a resumption of the rally from the low of 112.79 and open the doors to break above the recent high of 113.23.

- Notably, the bull flag breakout would bolster the already bullish setup indicated by the falling wedge breakout (witnessed on Friday) and ascending 50-, 100-, 200-hour exponential moving averages (EMAs).

- All-in-all, the bull flag breakout is more likely to happen. The bullish view would be invalidated below 113.00.

15-min Chart

Trend: Bullish

USD/JPY

Overview:

Last Price: 113.18

Daily change: -1.0 pips

Daily change: -0.00883%

Daily Open: 113.19

Trends:

Daily SMA20: 112.52

Daily SMA50: 112.34

Daily SMA100: 111.7

Daily SMA200: 109.93

Levels:

Daily High: 113.34

Daily Low: 112.56

Weekly High: 113.4

Weekly Low: 111.78

Monthly High: 114.56

Monthly Low: 111.38

Daily Fibonacci 38.2%: 113.04

Daily Fibonacci 61.8%: 112.85

Daily Pivot Point S1: 112.72

Daily Pivot Point S2: 112.24

Daily Pivot Point S3: 111.93

Daily Pivot Point R1: 113.5

Daily Pivot Point R2: 113.81

Daily Pivot Point R3: 114.29