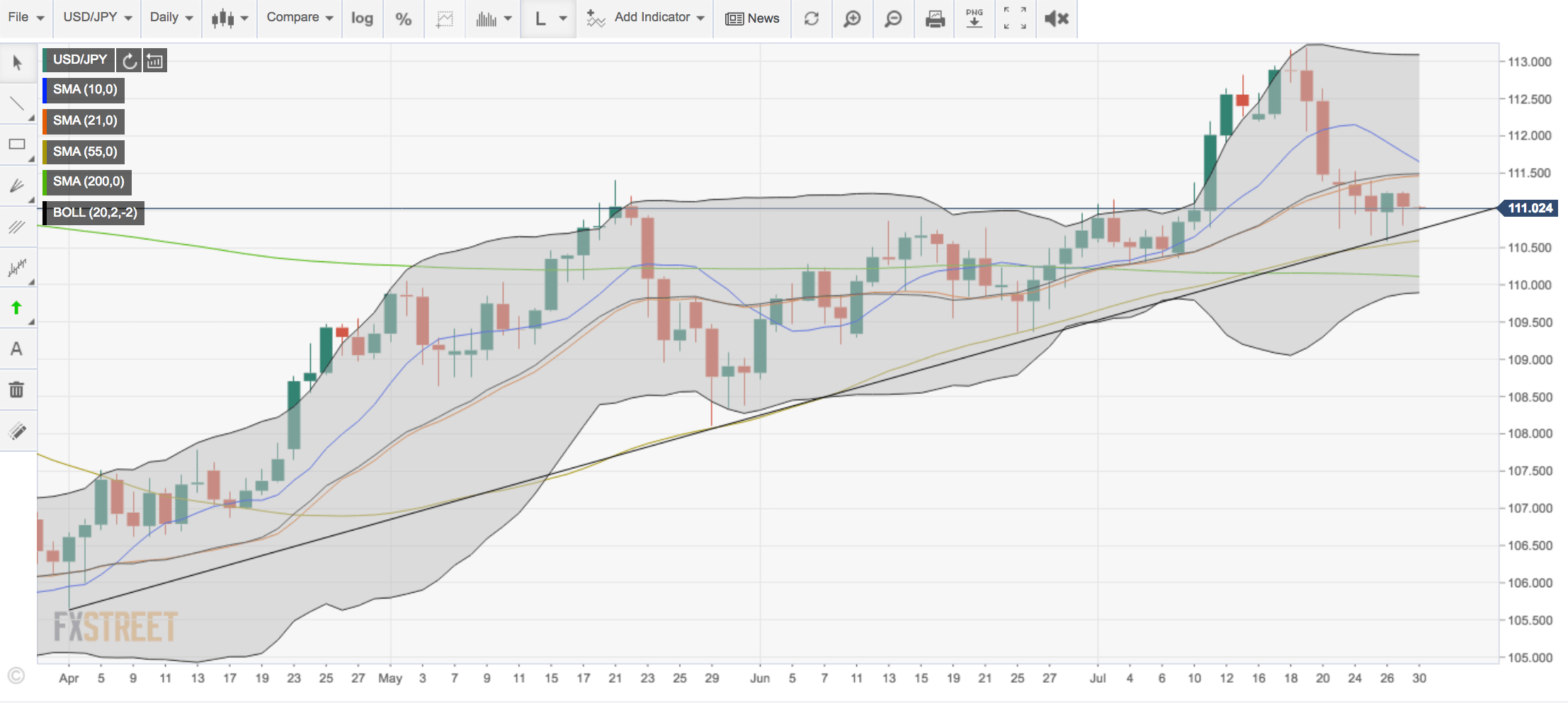

- USD/JPY is in consolidation ahead of the BoJ and key events for the week ahead, including the FOMC statement and nonfarm payrolls.

- USD/JPY is supported by the daily trendline support and resisted on the wide at the top of the cloud around 113.00 that guards the 200-week moving average at 113.29.

- The 200-D SMA comes in as a key support below the trendline.

Spot rate: 111.02

High: 111.10

Low: 110.88

Trend: Neutral

Resistance 1: 111.50/75

Resistance 2: 113.00 BB, guarding 200-week moving average at 113.29

Resistance 3: 114.73 November 2017 high

Resistance 4: On the wide, 125.86 comes as the 2015 high

Support 1: 55 day moving average at 110.56.

Support 2: 200 day ma at 110.09.

Support 3: 109.20 (8th June low)