With the relative strength index (RSI) on the 4-hour and hourly charts reporting oversold conditions with a below-30 print, USD/JPY could rise above 110.00 in the next few hours.

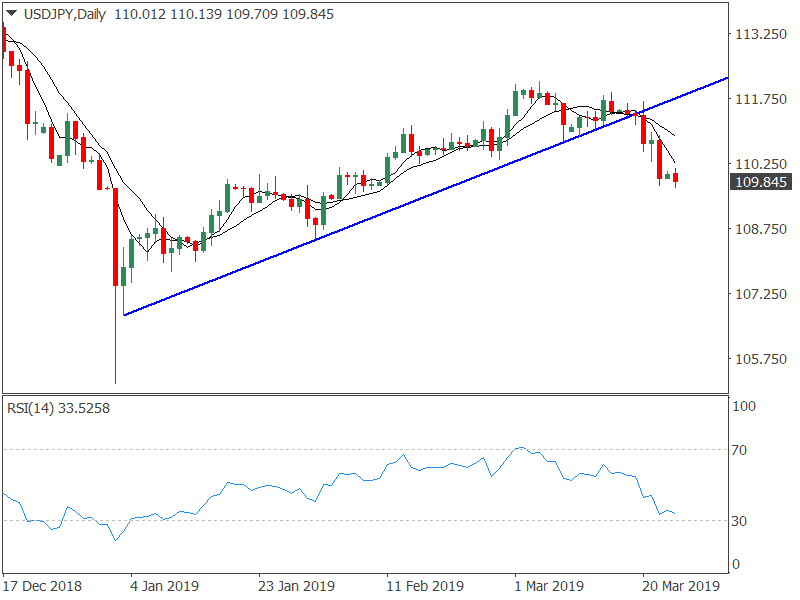

The corrective bounce, however, could be short-lived, as the daily chart is biased toward the bears – the pair closed below the trendline trending north from Jan. 4 and Jan. 31 lows, confirming a bull-to-bear trend change. Supporting that bearish case are the descending 5- and 10-day moving averages and the below-50 reading on the 14-day RSI.

The heightened recession fears and the resulting risk-off tone in the equities also indicate that the path of least resistance in USD/JPY is to the downside.

As of writing, the pair is trading 109.84, having hit a low of 109.70 earlier today.

Daily chart

Trend: Bearish