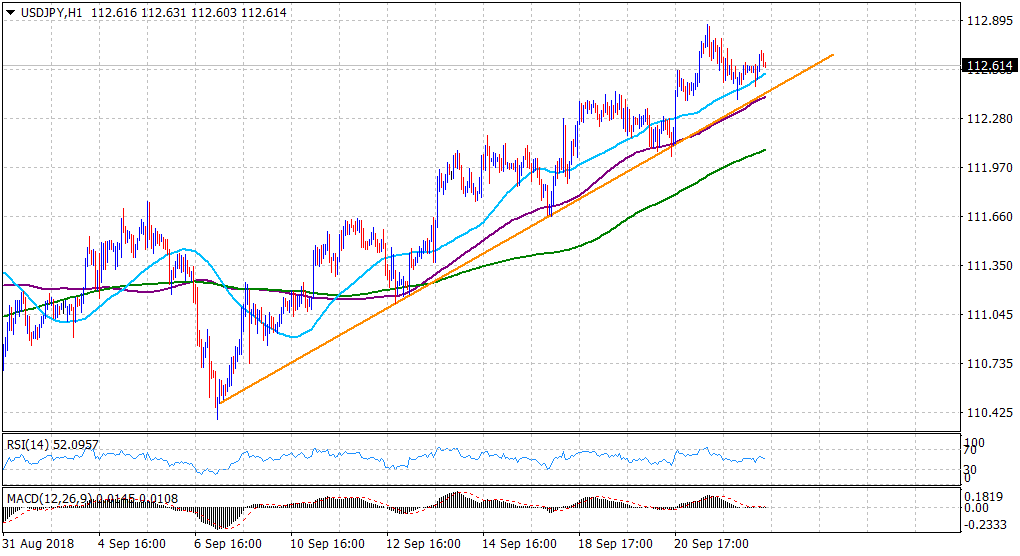

“¢ The pair has been trending higher alongside an ascending trend-line over the past two-week or so and is currently placed within striking distance of two-month tops set on Friday.

“¢ The fact that the pair has managed to hold comfortably above important moving averages – 50, 100 &200-period SMAs on the 1-hourly chart support prospects for additional gains.

“¢ However, technical indicators on the mentioned chart are yet to pick up positive momentum and seemed to be the only factor keeping a lid on any runaway rally for the major.

“¢ Traders seemed to await the BoJ Governor Haruhiko Kuroda’s scheduled speech on Tuesday, which along with Wednesday’s FOMC decision will provide a fresh directional impetus.

Spot Rate: 112.61

Daily High: 112.71

Daily Low: 112.40

Trend: Bullish

Resistance

R1: 112.87 (Friday’s 2-month tops)

R2: 113.10 (R2 daily pivot-point)

R3: 113.39 (YTD high set on Jan. 8)

Support

S1: 112.40 (100-period SMA H1)

S2: 112.17 (S2 daily pivot-point)

S3: 112.00 (round figure mark)