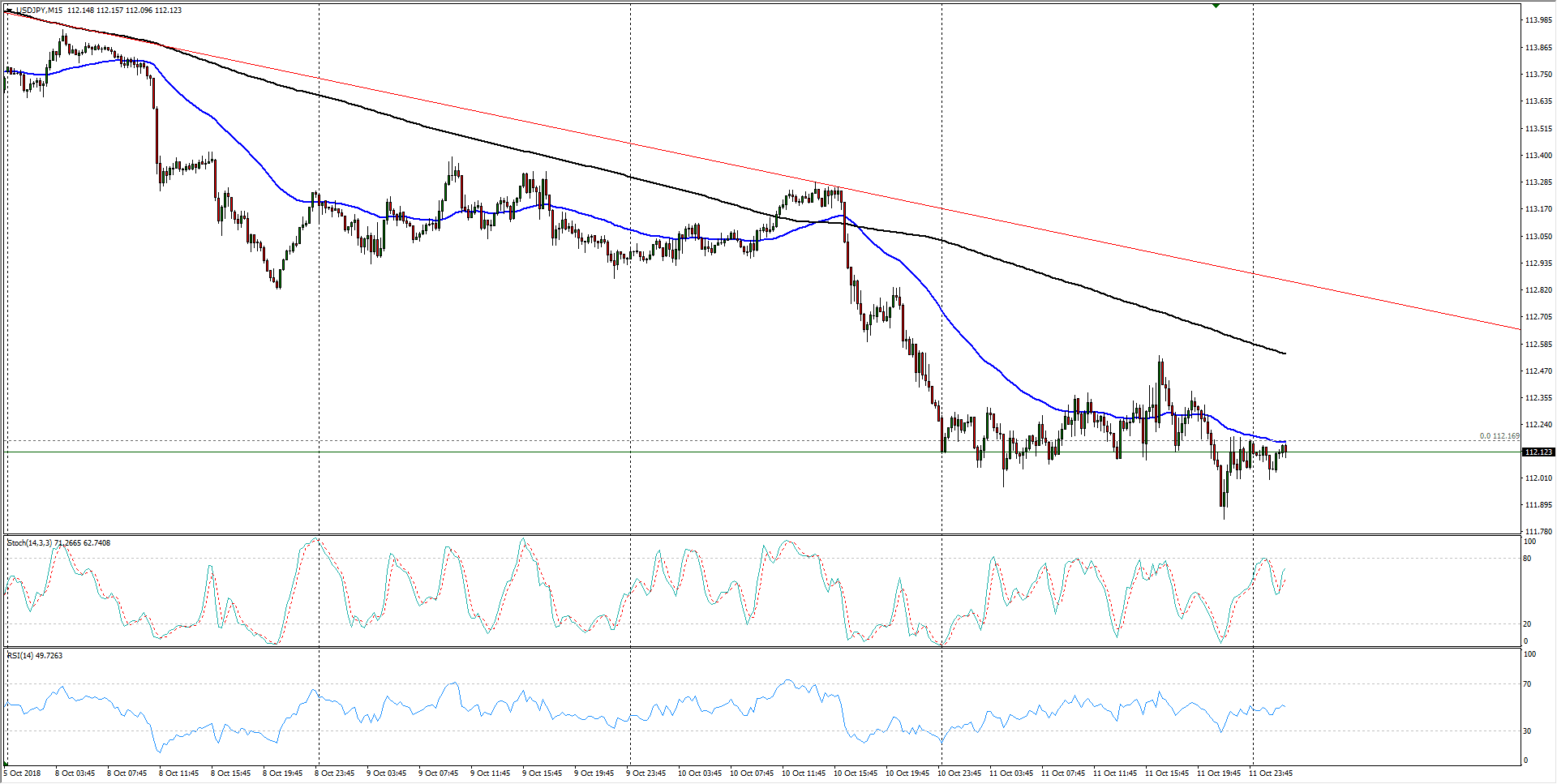

- The Dollar has seen steady declines against the Japanese Yen this week, and the pair appears to be gathering up for another push lower.

- The 112.00 handle remains a key trigger for the Dollar-Yen pairing after yesterday’s consolidation, and hourly indicators are middling as the pair remains constrained by the 200-period EMA at 112.55.

- A firm bearish trendline from last week’s peak at 114.55 remains intact and is helping steer the Greenback.

USD/JPY

Overview:

Last Price: 112.15

Daily change: -12 pips

Daily change: -0.107%

Daily Open: 112.27

Trends:

Daily SMA20: 112.97

Daily SMA50: 111.82

Daily SMA100: 111.23

Daily SMA200: 109.84

Levels:

Daily High: 113.3

Daily Low: 112.26

Weekly High: 114.56

Weekly Low: 113.52

Monthly High: 114.56

Monthly Low: 110.85

Daily Fibonacci 38.2%: 112.65

Daily Fibonacci 61.8%: 112.9

Daily Pivot Point S1: 111.92

Daily Pivot Point S2: 111.56

Daily Pivot Point S3: 110.87

Daily Pivot Point R1: 112.96

Daily Pivot Point R2: 113.65

Daily Pivot Point R3: 114.01