- USD/JPY is trading at daily highs challenging the 107.40 resistance.

- The FOMC Minutes are scheduled at 18:00 GMT; the news can lead to some volatility in USD-related currency pairs.

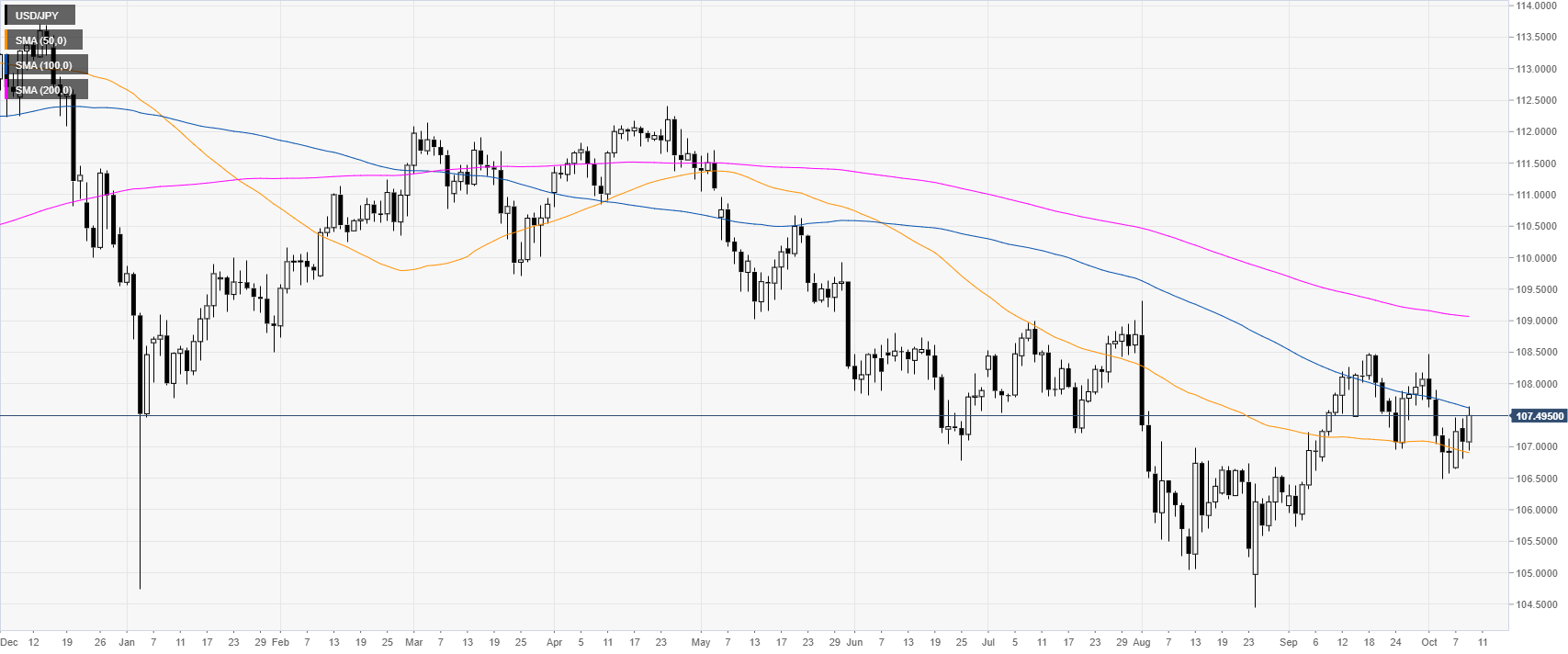

USD/JPY daily chart

The USD/JPY exchange rate is trading in a bear trend below its 100 and 200-day simple moving averages (DSMAs). However, the spot is attempting to find some support near the 50 SMA at the 106.90 level. The FOMC Minutes were a non-event with little market reaction. Chief’s Powell reiterated what most market players already know: “risks come from abroad, chances of a recession are limited and the economy overall is healthy.”

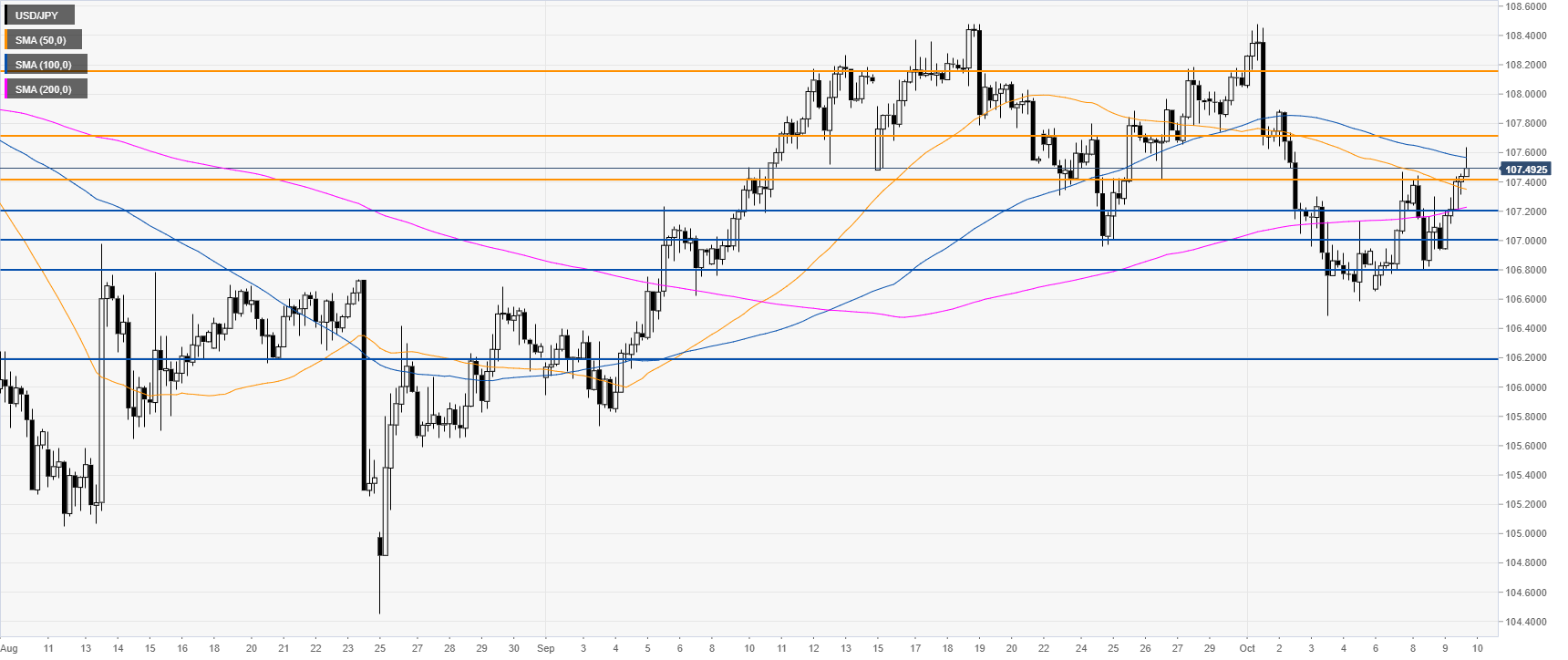

USD/JPY four-hour chart

USD/JPY is settling above the 107.40 resistance while challenging the 100 SMA on the four-hour chart. The market might try to reach 107.70 resistance on the way up, according to the Technical Confluences Indicator. A break of the level can expose 108.16 resistance if the bulls gather enough steam.

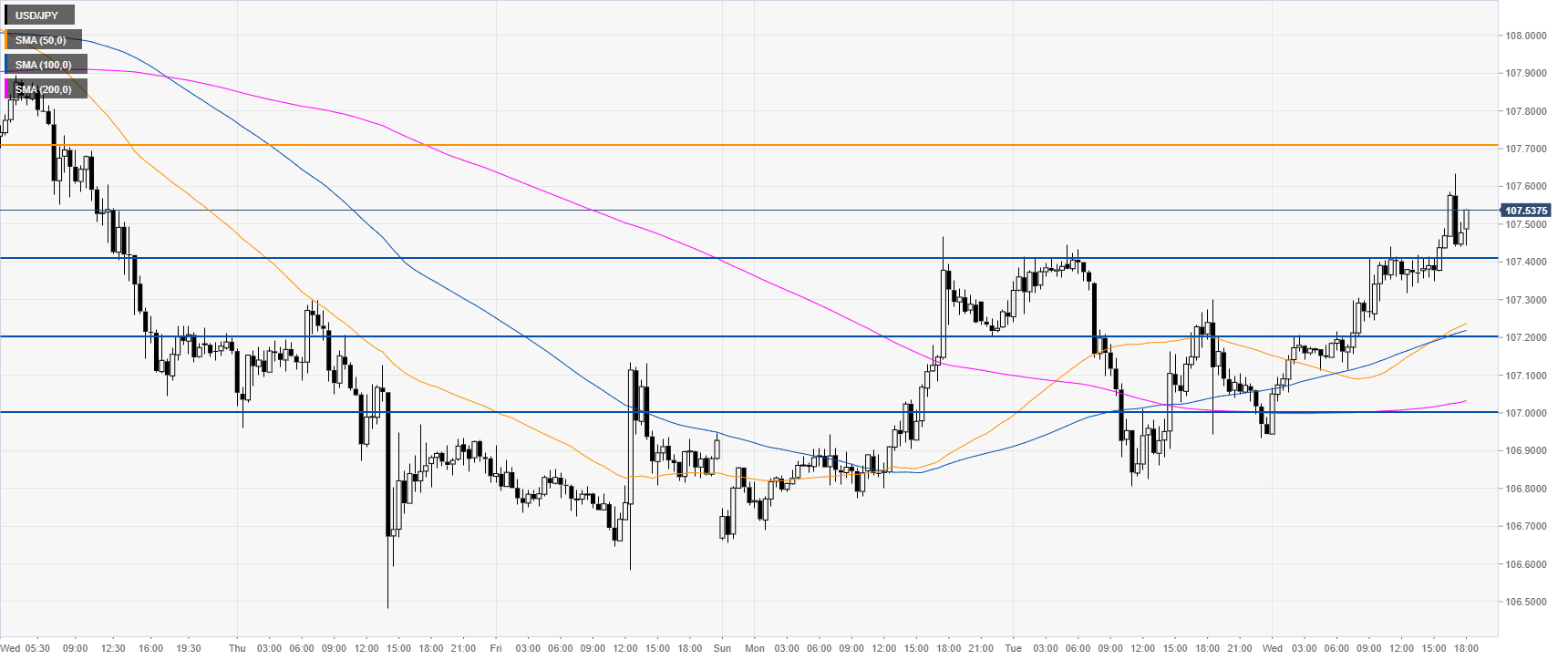

USD/JPY 30-minute chart

The USD/JPY currency pair is trading above the main SMAs, suggesting bullish momentum in the near term. Immediate supports are seen at the 107.40/20 support zone and 107.00 figure, according to the Technical Confluences Indicator.

Additional key levels