- USD/JPY is up as US indices are well supported this Wednesday.

- The levels to beat for bulls are at the 106.31 and 106.69 levels, according to the Technical Confluences Indicator.

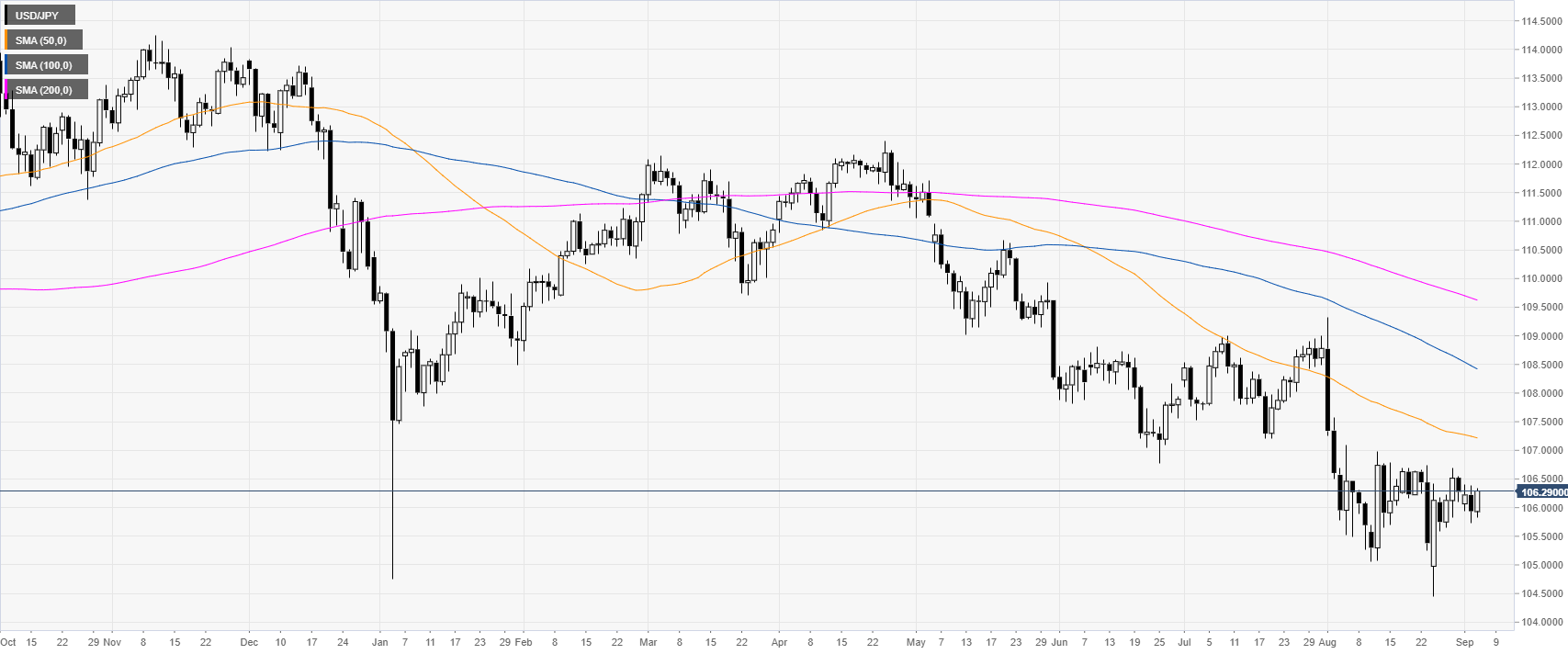

USD/JPY daily chart

USD/JPY is in a bear trend below the main daily simple moving averages (DSMAs). The market has been choppy in the last month of trading, coiling around the 106.00 figure. Despite broad-based USD weakness USD/JPY is firm as the demand for Yen is weak. The risk-on sentiment with US indices in the green is helping USD/JPY to stay afloat.

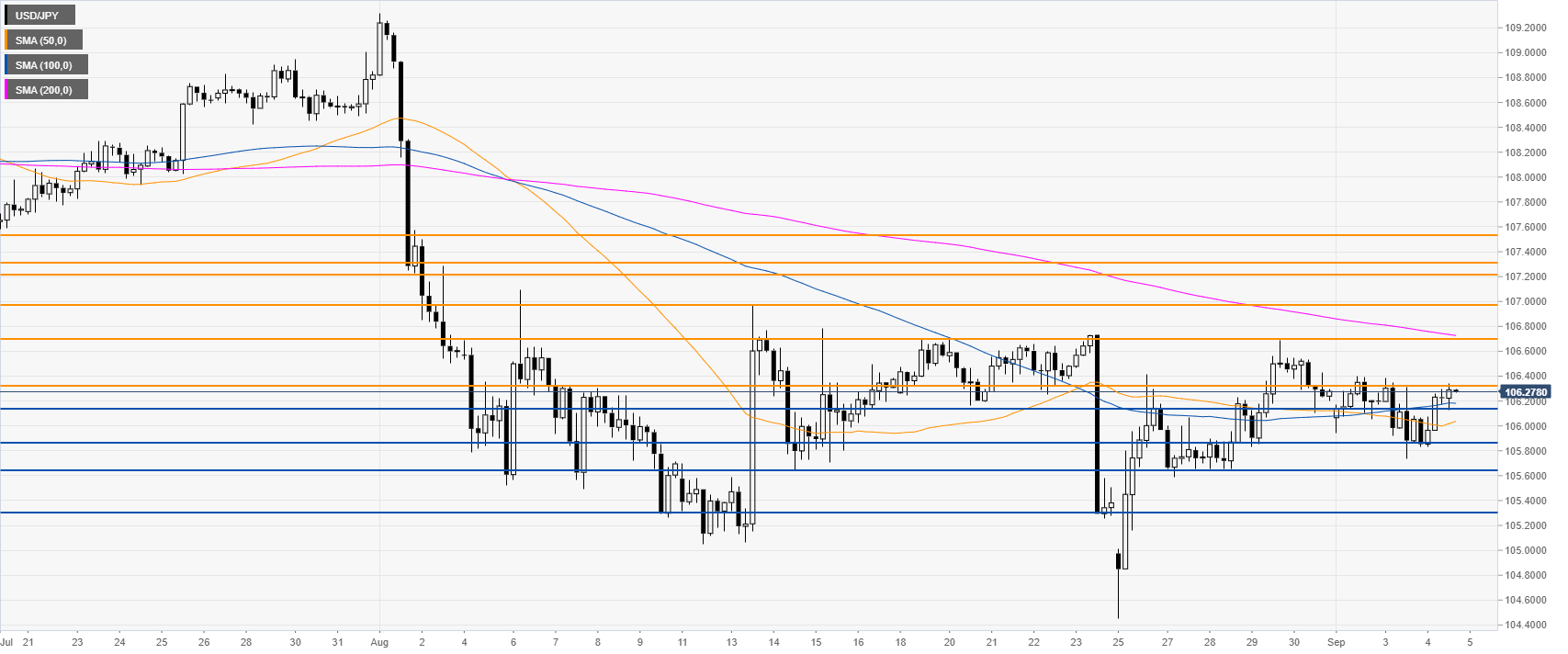

USD/JPY 4-hour chart

USD/JPY is challenging the 106.31 resistance above the 50/100 SMAs. Bulls would need a daily close above that level to drive the market up towards the 106.98 resistance, according to the Technical Confluences Indicator.

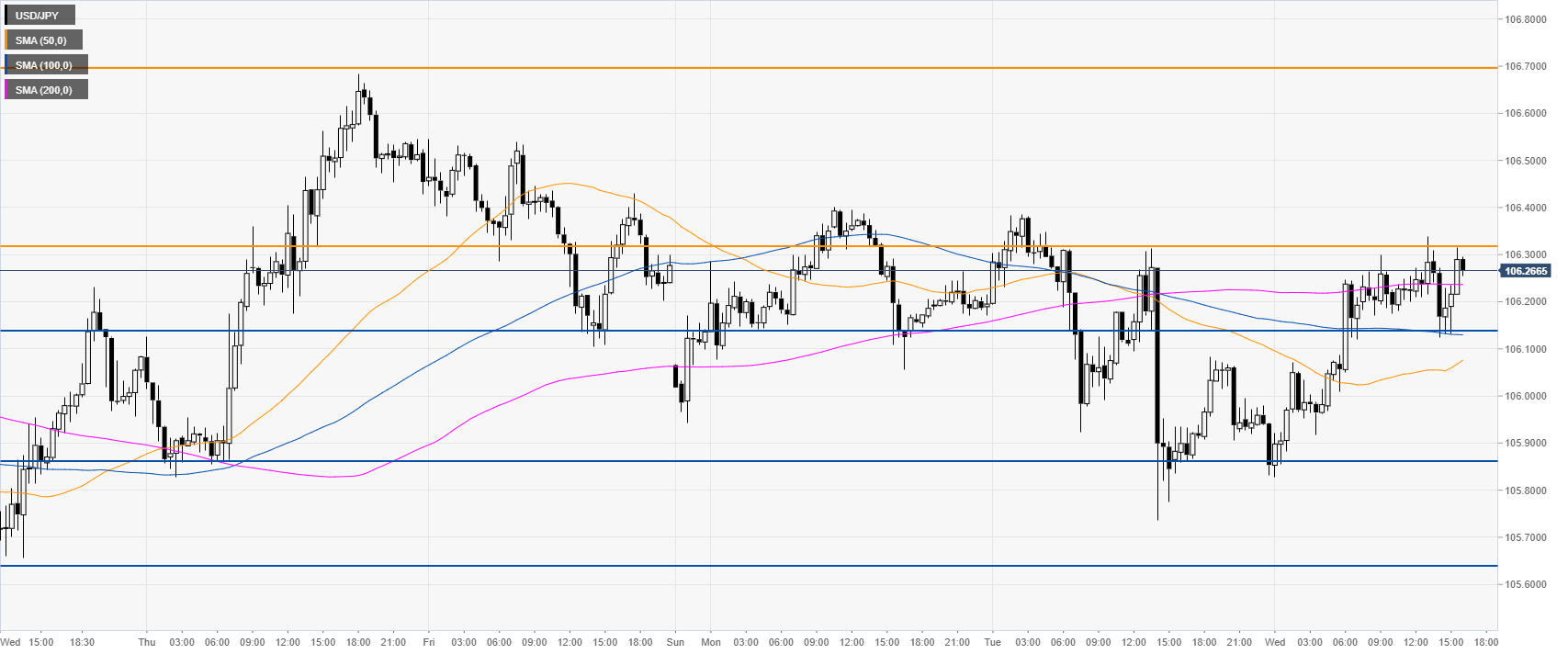

USD/JPY 30-minute chart

Dollar/Yen is trading near the weekly highs above the main SMAs, suggesting potential bullish momentum in the near term. Immediate support is seen at the 106.14 and 106.00 level, according to the Technical Confluences Indicator.

Additional key levels