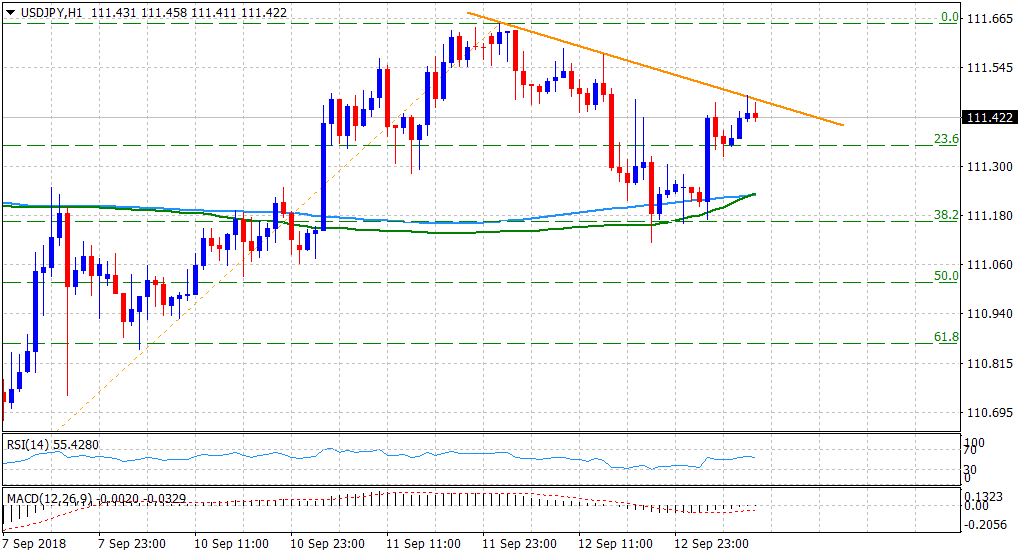

“¢ Optimism over a new round of US-China trade talks helped bulls defend an important moving averages (100 & 200-hour SMA) confluence support on Wednesday.

“¢ The mentioned support coincided with 38.2% Fibo. level of the 110.38-111.65 up-move and thus, assisted the pair to regain positive traction amid improving risk sentiment.

“¢ However, a short-term descending trend-line was now seen acting as key resistance and thus, limiting any potential break higher, at least for the time being.

“¢ A convincing break through the said hurdle might turn out to be a key defining level for bullish traders and increasing prospects for an extension of the intraday positive move.

Spot Rate: 111.42

Daily Low: 111.16

Trend: Bullish above trend-line resistance

Resistance

R1: 111.65 (one-week tops set yesterday)

R2: 111.90 (R2 daily pivot-point)

R3: 112.15 (August monthly swing high)

Support

S1: 111.23 (100/200-period SMA H1)

S2: 111.03 (S1 daily pivot-point)

S3: 110.85 (weekly low set on Monday)