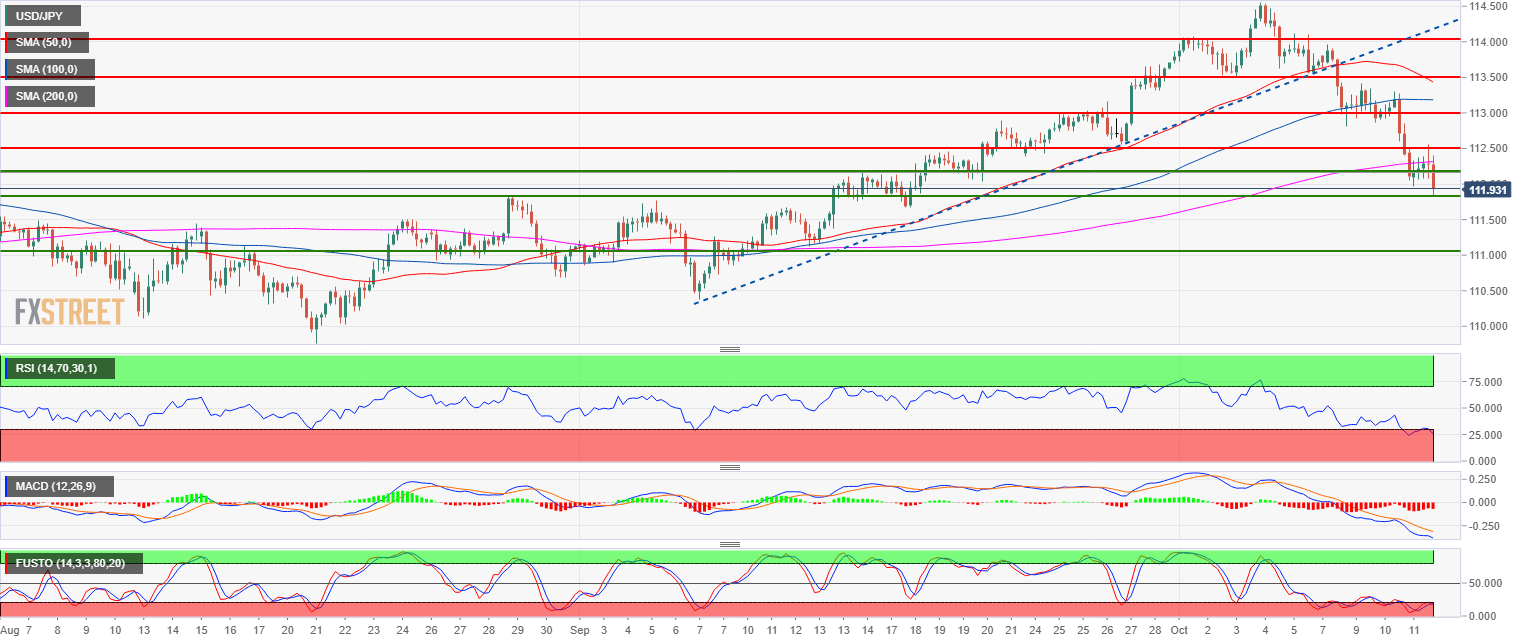

- USD/JPY bull trend is on hold as the market is having a strong pullback down.

- USD/JPY is trading below its 200-period simple moving average (SMA) while the MACD indicator is remaining in negative territories. The bearish bias is kept as long as USD/JPY is capped by 112.55 resistance and 200 SMA

- Targets to the downside are seen near 111.84 August 29 swing high and 111.00 figure.

USD/JPY 4-hour chart

Spot rate: 112.00

Relative change: -0.23%

High: 112.53

Low: 111.83

Main trend: Bullish

Short-term trend: Bearish

Resistance 1: 112.55 September 27 low

Resistance 2: 113.00 figure

Resistance 3: 113.55 October 2 low

Resistance 4: 113.55 October 2 low

Resistance 5: 114.00 figure

Resistance 6: 114.80 November 2017 high

Resistance 7: 115.50 March 10, 2017 high

Support 1: 112.00-112.17 zone, figure and August 1 swing high

Support 2: 111.84 August 29 swing high

Support 3: 111.00 figure