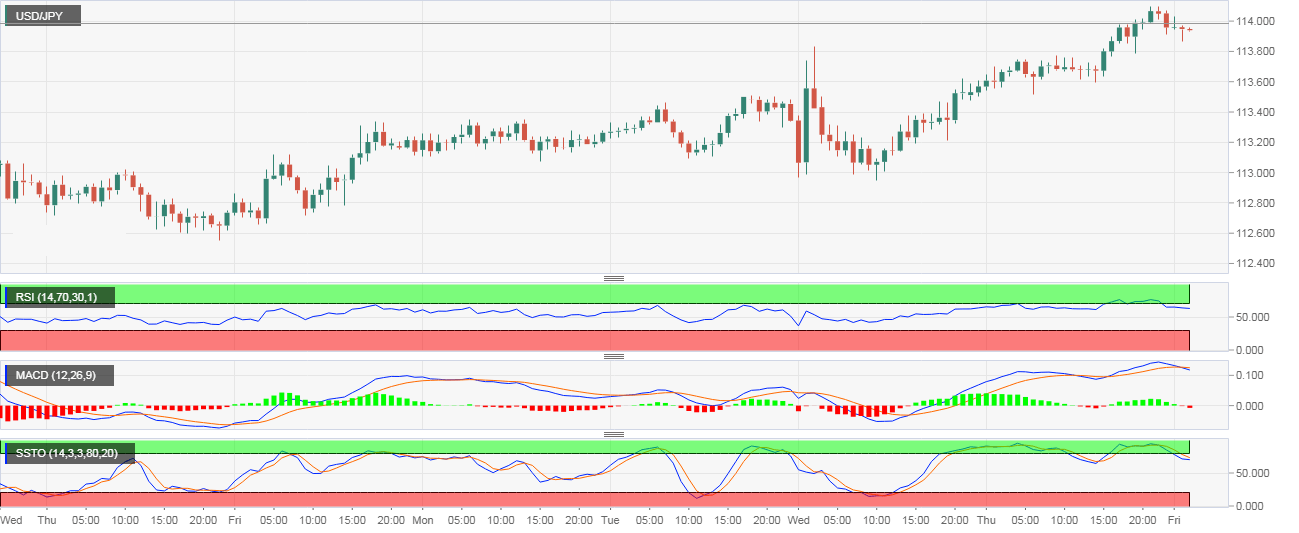

- The USD/JPY is currently trading at 113.92, down 0.12 percent on the day, and could drop further to the 5-day exponential moving average (EMA) of 113.65 as the indicators on the hourly chart have rolled over in favor of the bears.

- For instance, the hourly chart RSI is flashing a bearish divergence and has eroded the rising trendline. The stochastic has rolled over from the overbought territory and the MACD is producing a bearish crossover.

- The pullbacks, however, could be short-lived as the pair closed yesterday above the previous day’s high of 113.82, bolstering the already bullish setup on the daily chart: higher lows and higher highs and ascending 5-, 10-, 50-day EMAs.

Hourly Chart

Trend: minor pullback likely before further gains

USD/JPY

Overview:

Last Price: 113.88

Daily change: -11 pips

Daily change: -0.0965%

Daily Open: 113.99

Trends:

Daily SMA20: 112.7

Daily SMA50: 112.53

Daily SMA100: 111.83

Daily SMA200: 110.02

Levels:

Daily High: 114.02

Daily Low: 113.48

Weekly High: 113.4

Weekly Low: 111.78

Monthly High: 114.56

Monthly Low: 111.38

Daily Fibonacci 38.2%: 113.81

Daily Fibonacci 61.8%: 113.68

Daily Pivot Point S1: 113.64

Daily Pivot Point S2: 113.28

Daily Pivot Point S3: 113.09

Daily Pivot Point R1: 114.18

Daily Pivot Point R2: 114.37

Daily Pivot Point R3: 114.73