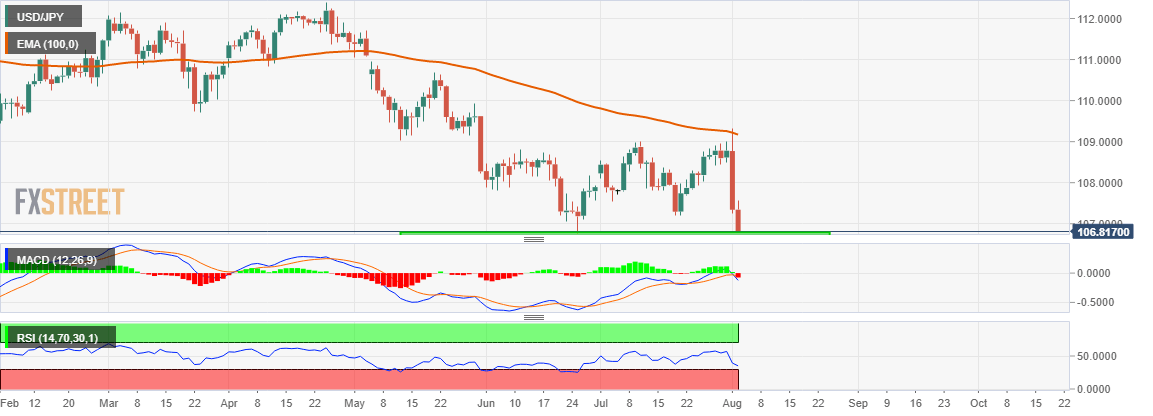

- The USD/JPY pair extended the previous session’s sharp rejection slide from 100-day EMA and remained under some heavy selling pressure for the second consecutive session on Friday.

- The pair is currently placed near multi-month lows – around the 106.80-75 region, as market participants await Friday’s important release of the US NFP report for some meaningful impetus.

Meanwhile, technical indicators on hourly charts are flashing extreme oversold conditions and support prospects for a modest bounce back towards the 107.15-20 region, albeit bearish oscillator on the daily chart warrant some caution before placing any aggressive bullish bets.

Sustained move beyond the mentioned resistance might prompt some aggressive short-covering move towards 107.85-108.00 region before the pair eventually aims to test the 108.50 intermediate resistance ahead of the 108.80-85 region and the 109.00 round figure mark.

Alternatively, a breakthrough the current support area will set the stage for a further near-term depreciating move and accelerate the slide towards the 106.25 intermediate support. The bearish trajectory could further get extended towards the 106.00 handle en-route mid-105.00s.

USD/JPY daily chart