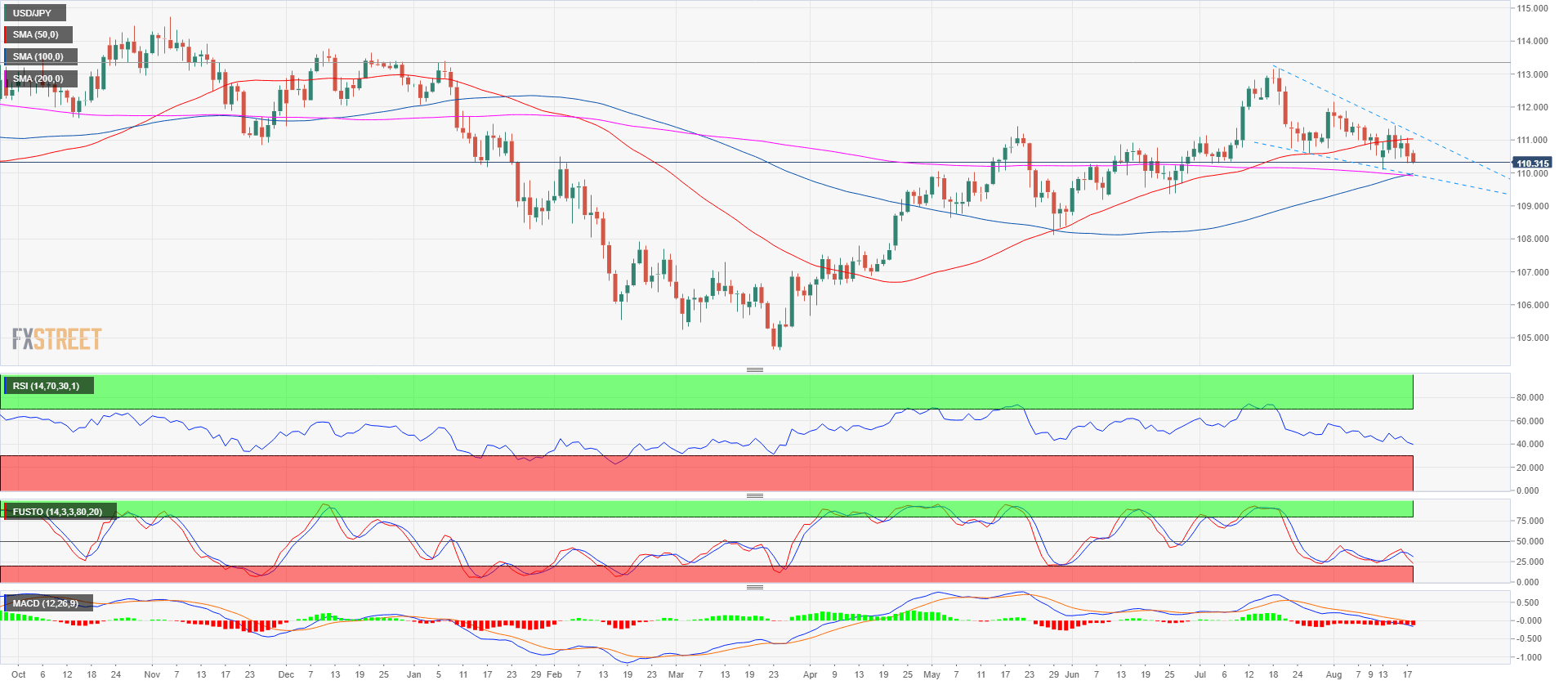

- USD/JPY main trend has paused since July, 19 as the market is in a triangle consolidation.

- USD/JPY is challenging last Friday’s low as the market has rejected the 50-daily simple moving average. Bears target is 110.10 August 13 swing low and the trendline.

- A bull breakout above 111.45 swing high would negate the short-term bearish bias.

Spot rate: 110.31

Relative change: -0.17%

High: 110.70

Low: 110.26

Main trend: Bullish

Short-term trend Bearish below 110.45

Resistance 1: 110.40 demand level

Resistance 2: 110.58 July 26 swing low

Resistance 3: 110.75, July 23 low

Resistance 4: 110.90 June 15 swing high

Resistance 5: 111.02-111.16 area, figure and current August 6 low

Resistance 6: 111.45 August 8 high

Resistance 7: 111.54-111.64 area, August 6, high and supply/demand level

Support 1: 110.10 August 13 swing low

Support 2: 109.37 June 25 swing low

Support 3: 109.19 June 8 low