- USD/JPY is struggling to keep the bull momentum going this Friday as the market is currently reversing the gains made earlier in the day.

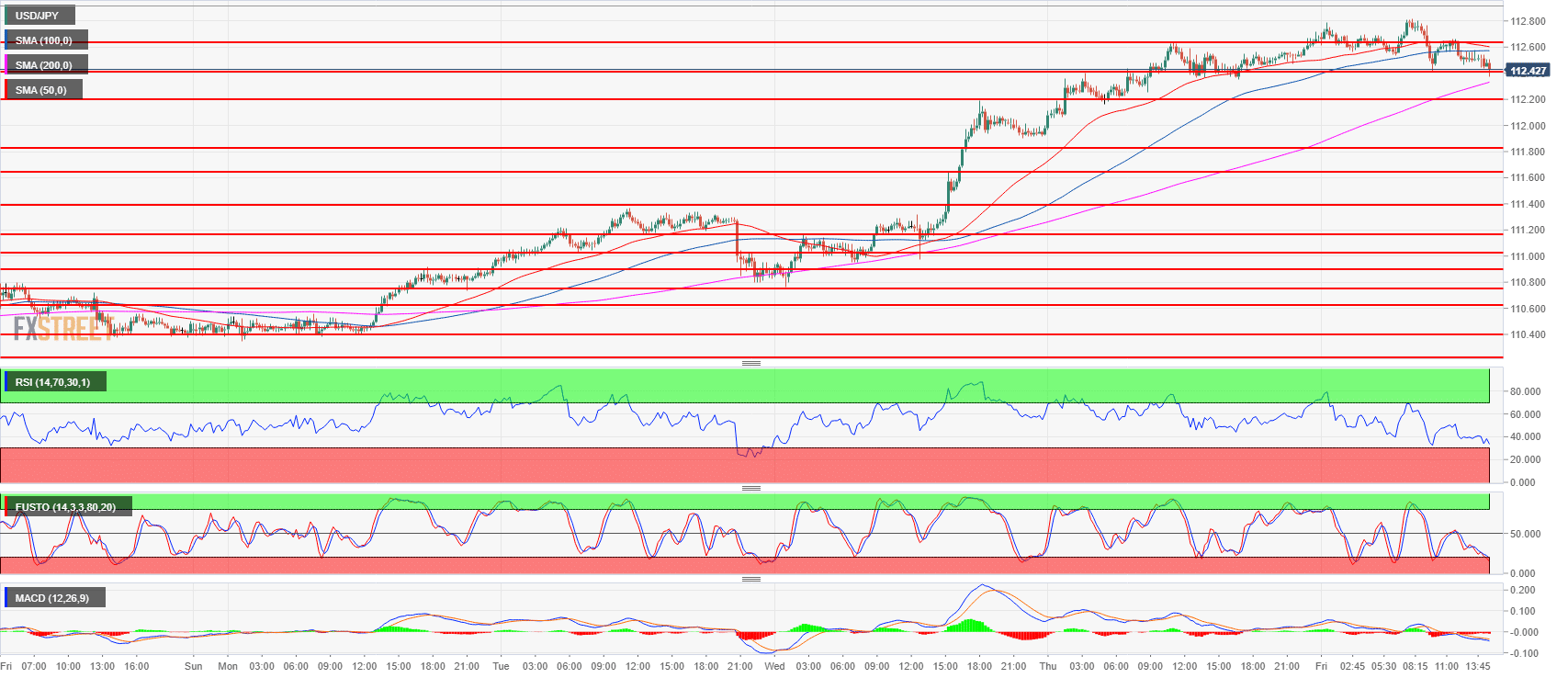

- USD/JPY is now trading below its 50 and 100-period simple moving averages suggesting that the market is entering a consolidation phase after the recent 260-pip bull run.

- Near-term supports are seen near the 112.40 intraday swing low and 112.19, July 11 high while resistances are seen near 112.64 July 12 high and 112.82, the current Friday’s high.

USD/JPY 15-minute chart

Spot rate: 112.42

Relative change: -0.12%

High: 112.82

Low: 111.37

Trend: Neutral

Resistance 1: 112.64 July 12 high

Resistance 2: 112.82 July 13 high

Resistance 2: 113.38 January 8 high

Resistance 3: 114.45 October 27, 2017 high

Support 1: 112.40 intraday swing low

Support 2: 112.19, July 11 high

Support 3: 111.60-111.80 area, 23.6% and 23.2% Fibonacci retracement low/high July 11

Support 4: 111.39 May 21 swing high

Support 5: 111.02-111.16 previous intraday swing lows

Support 6: 110.90 June 15 swing high