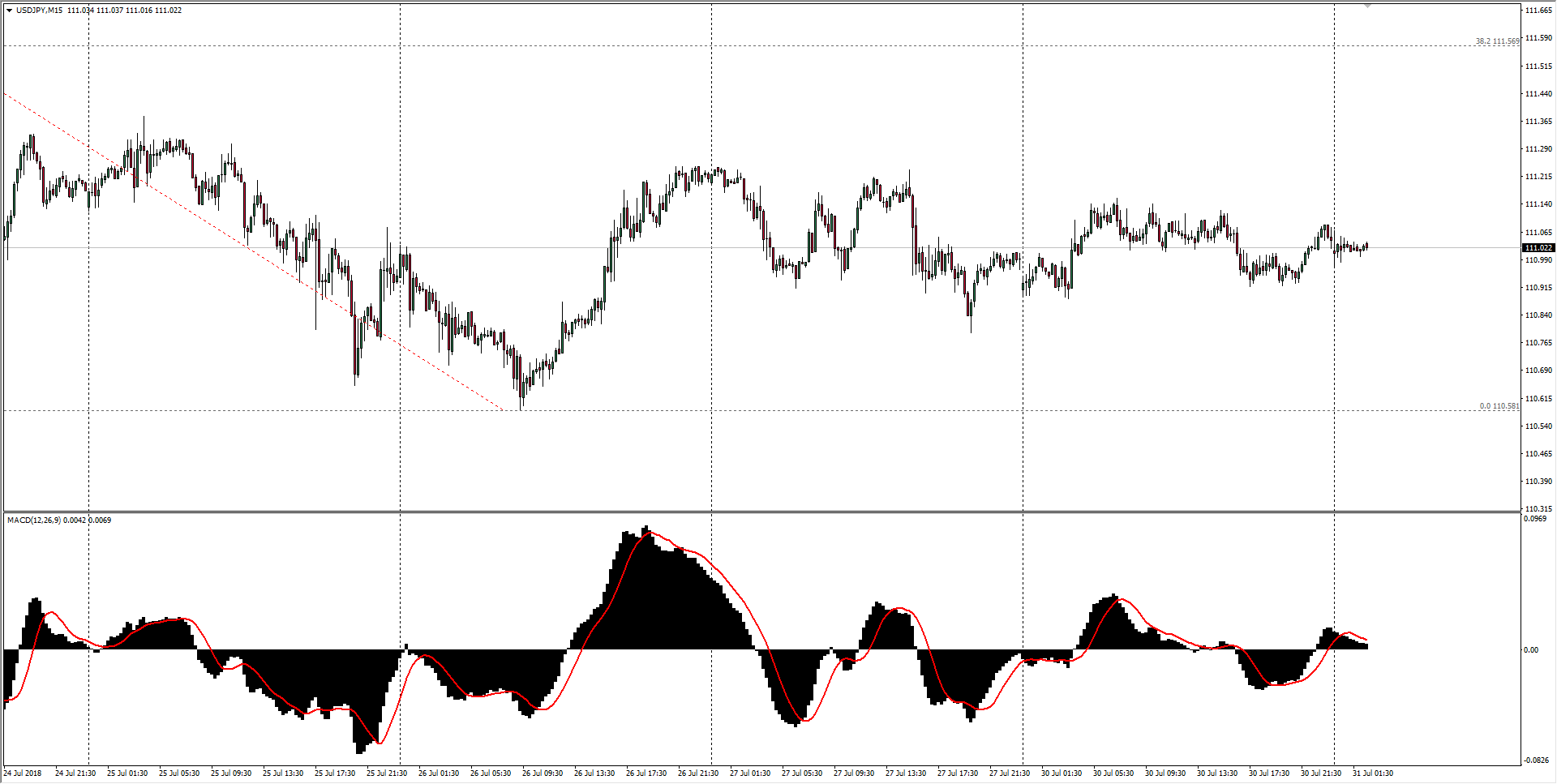

- The Dollar-Yen pairing continues to twist sideways ahead of the BoJ’s policy statement due early for Tuesday, trading close to the 111.00 major handle ahead of expected action from the Japanese central bank.

- A floor has been priced in at last week’s bounces from a floor just above 110.60, and markets seem to be expecting a Yen-positive BoJ outcome, which would see the USD/JPY head into June’s lows below 110.00, but an oversold bounce will see the pair recover to near-term highs for July around 112.00 and 113.00.

| Spot rate: | 111.02 |

| Relative change: | Negligible |

| High: | 111.06 |

| Low: | 110.97 |

| Trend: | Flat |

| Support 1: | 110.88 (current week low) |

| Support 2: | 110.58 (previous week low) |

| Support 3: | 110.27 (July low) |

| Resistance 1: | 111.15 (current week high) |

| Resistance 2: | 111.53 (previous week high) |

| Resistance 3: | 112.18 (61.8% Fibo retracement level) |