- The Bank of Japan is one of the few central banks with a loose monetary policy.

- Investors will closely watch next week’s inflation data to see if there is a need for a tighter policy.

- The USD/JPY is looking to break above the 135.50 level in the charts.

The USD/JPY weekly forecast is bullish as the pair could rally more on monetary policy divergence and roaring greenback.

Ups and downs of USD/JPY

The USD/JPY reacted to the Fed rate hike on Wednesday by pushing lower, as investors had anticipated the 75bps hike. However, Friday, the Bank of Japan’s dovish comments saw the pair resume its bullish trend.

-Are you interested in learning about forex live calendar? Click here for details-

The yen fell by 1.9% after the interest rate decision by the Bank of Japan, which held its negative rates. This news disappointed some investors who had speculated that the BOJ would give in to market pressures and tighten its policy.

However, policymakers were concerned about the yen’s recent sharp declines and its effect on the economy. As its peers aggressively tighten monetary policy to try and control rising inflation, the BOJ’s position as the world’s last major dovish central bank holds.

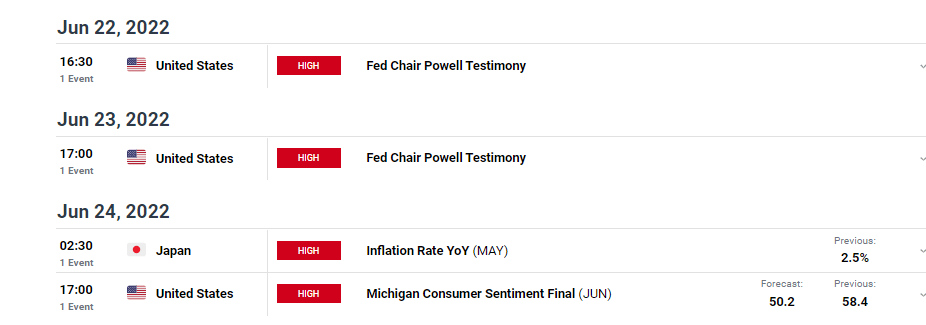

Next week’s key events for USD/JPY

Japan’s inflation has been lower compared to the US and the UK. Investors will wait to see if this trend goes on next week when Japan releases its inflation rate. Higher inflation could be the one thing that finally pushes the Bank of Japan to take a less dovish stand on monetary policy.

Policymakers in Japan have started to get concerned about the sharp declines in the local currency’s value, but whether they will act on these concerns remains unknown.

-Are you interested in learning about forex signals? Click here for details-

USD/JPY weekly technical forecast: Bulls ready to break above 135.50

The daily chart shows the story of a bull market. Every indicator points to higher prices for USD/JPY. The RSI is trading well above the 50 level, showing a lot of bullish momentum, and the price is trading above the 22-SMA.

The 135.50 level offered some resistance, which saw the price push lower. A break of this level could push the price beyond 136.00. If the price cannot break through this level, we could see some consolidation or a push lower. However, the bias remains bullish until we see a break below the 22-SMA and RSI below the 50 levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money