- USD/JPY falls paring off the weekly gains.

- US bonds yields are falling, weighing on the Greenback.

- Fed’s cautiousness showed in Jackson Hole disappointed the Dollar bulls.

The weekly forecast for the USD/JPY is bearish as the prices plummeted on Friday after Powell’s speech. Fed showed concerns for the economy that weighed on the Greenback.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

On Wednesday, the USD/JPY crossed above 110.00 for the first time in two weeks amid global risk aversion due to a new Covid pandemic, higher US Treasury yields and expectations that the Federal Reserve may announce a reduction of its bond purchases program.

Neither interest rate hawks nor the dollar was surprised by Fed Chairman Jerome Powell’s long-awaited speech at the Jackson Hole symposium on Friday. Powell said a rate cut is likely by the end of the year, but it should not be viewed as a rate hike since the economy still has a great deal of work to do.

US interest rates have been near historic lows for 18 months or more due to the Federal Reserve’s program to buy $120 billion in government bonds and mortgage-backed securities every month. Cutting these purchases will allow government bond rates to rise, but the Fed is determined to prevent rapid growth, so Chairman Powell argues that the reduction has nothing to do with raising interest rates.

Ten-year and two-year government bond rates moved little after the speech, falling about two basis points each, but both remained higher throughout the week. The dollar lost ground, but not dramatically. It lost about 30 points against the yen and 40 points against the euro. Early trading saw stocks rise, with the Dow Jones rising above 200 points.

Japan has currently enacted emergency measures for 33 of its 47 prefectures until September 12. However, Delta cases continue to rise as Tokyo limits have been in effect since July 12. According to Yoshihide Suga, the prime minister hopes to achieve a 60 percent vaccination rate sometime in September. Around 40% of the population, primarily the elderly, are currently protected.

Despite positive data in Japan, the yen did not gain much. A lower-than-expected consumer price level in Tokyo made headlines in August. In addition, consumer prices have fallen eight out of the last 12 months, including two months in a row. Consequently, there is very little hope for the national consumer price index, which is practically incapable of supporting the September 23 report by the Bank of Japan.

–Are you interested to learn more about making money in forex? Check our detailed guide-

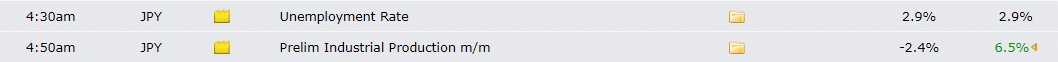

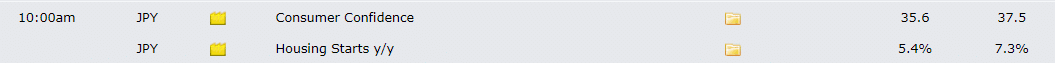

Key data from Japan during August 30 – September 03

There is no significant data from Japan next week. However, retail sales figures can be important as they reveal economic activity. Moreover, the unemployment indicators can also reveal the health of the Japanese economy. However, both the events are expected to provide no surprise to the market.

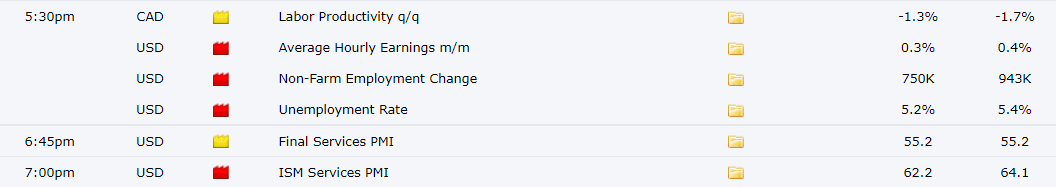

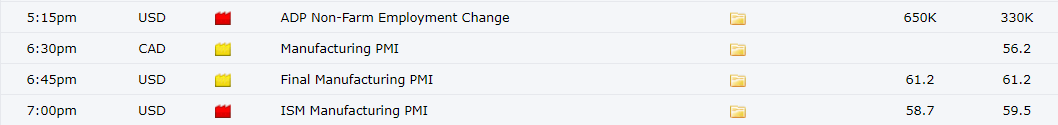

Key data from the US during August 30 – September 03

The most important event next week in US NFP which is expected to decline to 750k as expected to 943k jobs created in July. The ADP nonfarm employment numbers are expected to rise to 650k against 330k reading of July. ISM PMIs for manufacturing and services are also expected next week that may provide some impetus to the market.

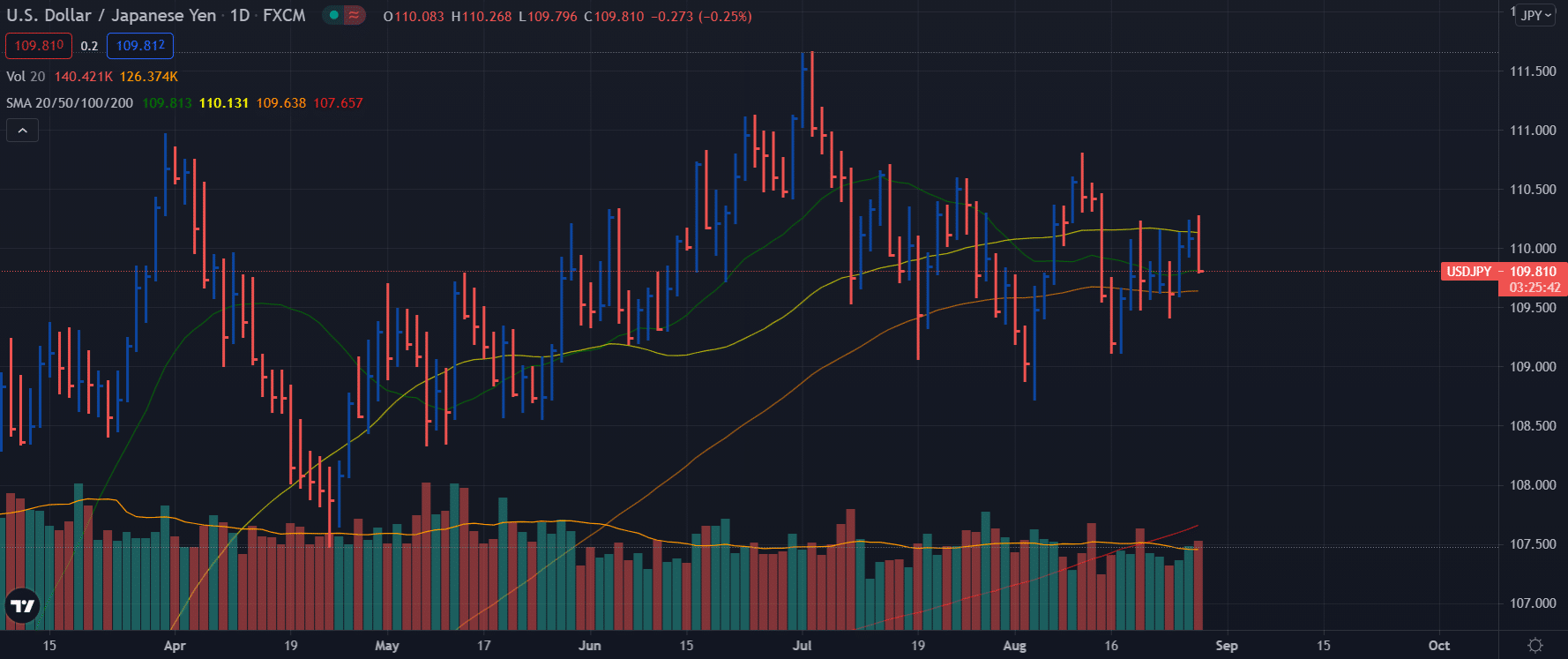

USD/JPY weekly technical forecast: 110.00 holds key importance

The daily chart of the USD/JPY pair is showing a bearish picture. The price falls but finds support at the 20-day moving average. However, the volume is too high that any upside retracement can be sold again. The 10-day SMA at 109.60 may lend further support. The next support lies at the demand zone of 109.00-10.

On the upside, the 110.00 round number provides resistance ahead of 50-day SMA at 110.20.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.