- USD/JPY managed to rise from the weekly lows of 114.15 and closed the week at 115.15.

- Poor ADP figures weighed on the USD but upbeat US NFP gave back the strength to the dollar.

- Market participants are looking at US inflation data next week.

The USD/JPY weekly forecast is slightly positive with an overall neutral bias as the price closed the week in the middle of a broad range.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Following Wednesday’s meeting of the Old World Twins and a weak US payroll report from ADP, the USD/JPY plunged to a weekly low of 114.16.

Interest rates were raised by 0.25 percent to 0.5% by the Old Lady of Threadneedle Street (BoE). Moreover, in March, the governors approved a passive draw from the balance sheet. However, most of the Monetary Policy Committee (MPC) wanted to double the rate hike to 0.5%.

Another surprise came from Christine Lagarde, President of the European Central Bank (ECB), who noted that inflation has risen on the continent.

ADP reported a loss of 301k and the start of claims for five weeks, causing the market to turn negative. On the other hand, Friday’s nonfarm payrolls in the US jumped by 467k, well beyond the estimate of 150k.

Revised NFP numbers were modestly positive for the year, increasing 217,000. Although November and December jobs increased by 709k to 647k and 510k, respectively, the end of the year was stronger than the original estimates. Participation in the labor force increased to 62.2%, the highest level since March 2020, showing that people are returning to the labor market in large numbers. Despite inflation and a number sure to catch the Fed’s attention, wages rose 0.7% m/m and 5.7% y/y.

In early trade on Friday, US Treasury yields rose sharply following the NFP report, with 2-year bonds gaining 11 basis points to 1.300% and commercial 10-year bonds gaining 8 basis points to 1.908%. As a result, the USD/JPY exchange rate climbed more than 40 pips to 115.45 resistance level, a functional high since January 11th.

Japan’s economic data showed no signs of improvement. The consumer confidence index unexpectedly fell to 36.7 in January, the lowest level since May. In January, Jibun Bank’s purchasing managers’ index (PMI) fell to 54.4 from 54.6. Among services, the index fell to 47.6, the first negative reading since September. In 2021, the Services PMI averaged 47.4.

NFP statistics were the only exception to a generally positive economic picture in the United States. The PMI for manufacturing rose, new orders fell, and employment reached its highest point in nine months. The PMI for services rose, orders fell, and employment peaked in nine months.

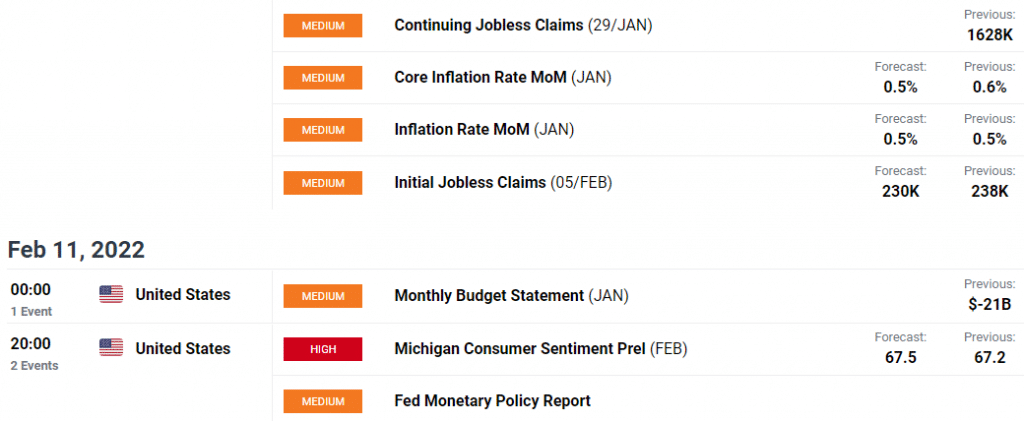

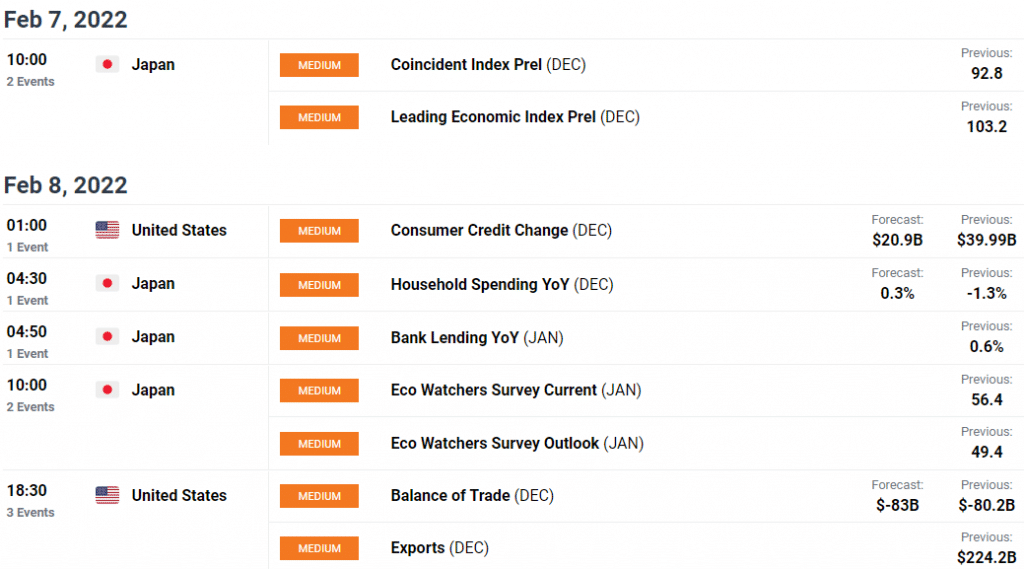

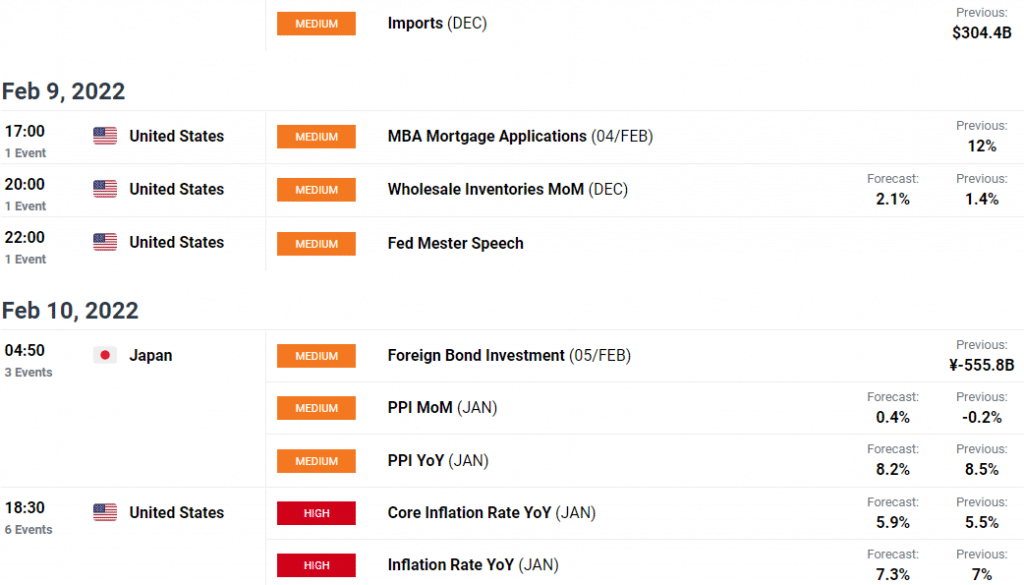

USD/JPY key data released next week

On Thursday, US inflation is expected to continue rising with a headline forecast of 7.3% and a core forecast of 5.9%. Japan’s data consists of the coincident and leading economic indicators for December, Eco Watchers surveys, and producer price indices for January.

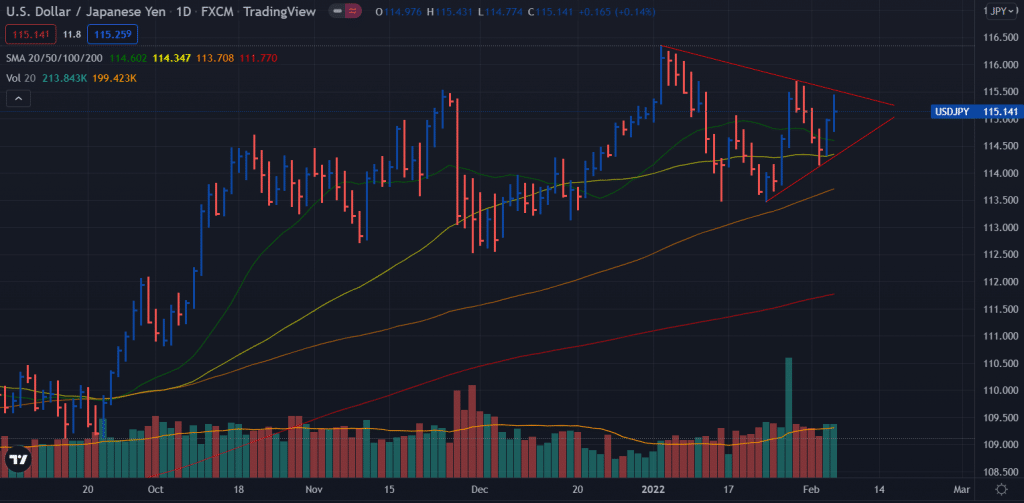

USD/JPY weekly technical forecast: Locked in a triangle

The USD/JPY price remains firm on the daily chart. Although Friday’s bar closed in the middle, the pair seems positive for another bull run. Another interesting thing to note is the triangle pattern on the daily chart. Traders should wait for a breakout on either side to find valid trading opportunities.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

On the upside, the pair’s ultimate resistance level is 116.50, while the major support level is 114.15. As of now, the pair is neutral and looking for a catalyst to find the directional bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.