- Japan’s economy unexpectedly contracted for the first time in a year.

- Japan’s core consumer inflation increased to a 40-year high in October.

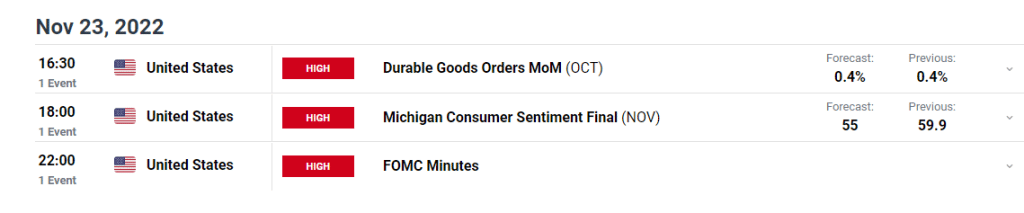

- Investors are awaiting the FOMC meeting minutes.

The USD/JPY weekly forecast is bearish as the Bank of Japan faces 40-year high inflation and may intervene to pull out from ultra-loose monetary policy.

Ups and downs of USD/JPY

The pair was moved by key economic releases from Japan and the US last week. Japan released GDP and inflation data. In the third quarter, Japan’s economy unexpectedly contracted for the first time in a year, fueling further concerns about the future as risks of a global recession, a weak yen, and increased import costs hurt consumer spending and business activity.

-Are you interested in learning about the forex signals telegram group? Click here for details-

In October, Japan’s core consumer inflation increased for 40-year due to currency weakness and pressure from rising import costs. The core consumer price index (CPI) for the entire country increased by 3.6% from a year earlier.

The US released PPI data that confirmed inflation had peaked, and retail sales data showed consumer spending was rising.

Next week’s key events for USD/JPY

Next week will be relatively quiet for USD/JPY as there will be very few economic releases. Investors will pay more attention to the FOMC meeting minutes. The minutes will provide a thorough account of the committee’s policy-setting meeting roughly two weeks earlier. Investors will scrutinize the minutes for hints regarding the outcome of upcoming interest rate decisions since they provide precise insights into the FOMC’s position on monetary policy.

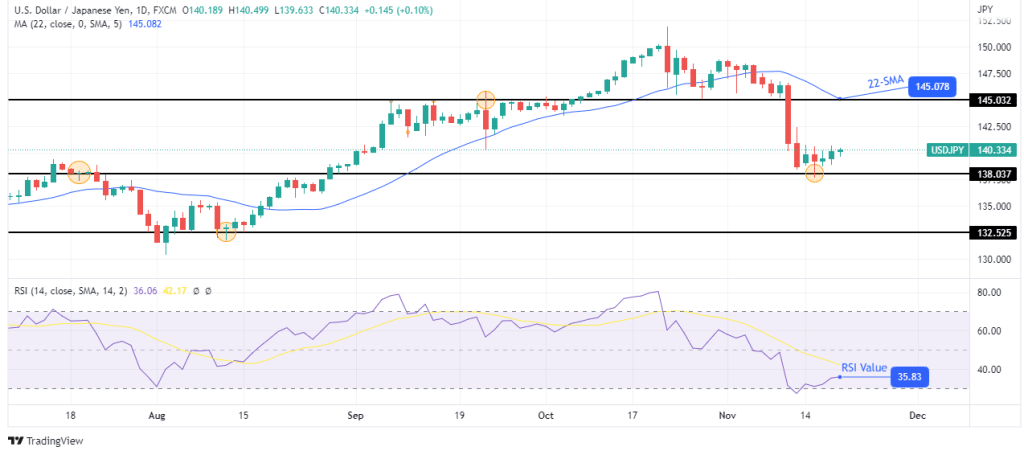

USD/JPY weekly technical forecast: Bears set to crack the 138.03 support

Looking at the daily chart, we see the price trading well below the 22-SMA and the RSI close to the oversold level. This is a sign that bears have a lot of momentum. The bearish trend began when the price broke below the 145.03 key level and moved to the 138.03 support.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Currently, the price has paused at the 138.03 support. This would be the best time for bulls to get in for a retracement of the recent move. However, bulls are not showing any strength, as the price is moving sideways. If this continues next week, we might see another explosive move to the downside, breaking below the 138.03 support and heading for the next support at 132.52. On the other hand, if bulls get a bit stronger, we might see the price pulling back to retest the 22-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.