- USD/JPY remained unchanged by the end of the week.

- The pair has potential for more gains amid stronger Greenback.

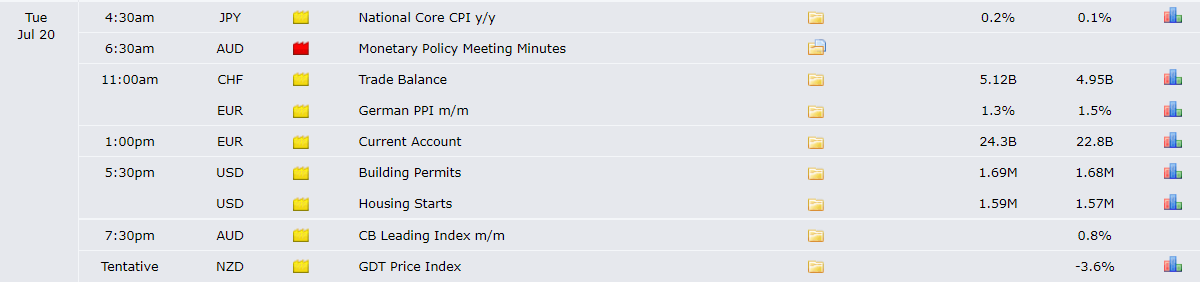

- Next week comes up with quite thin data.

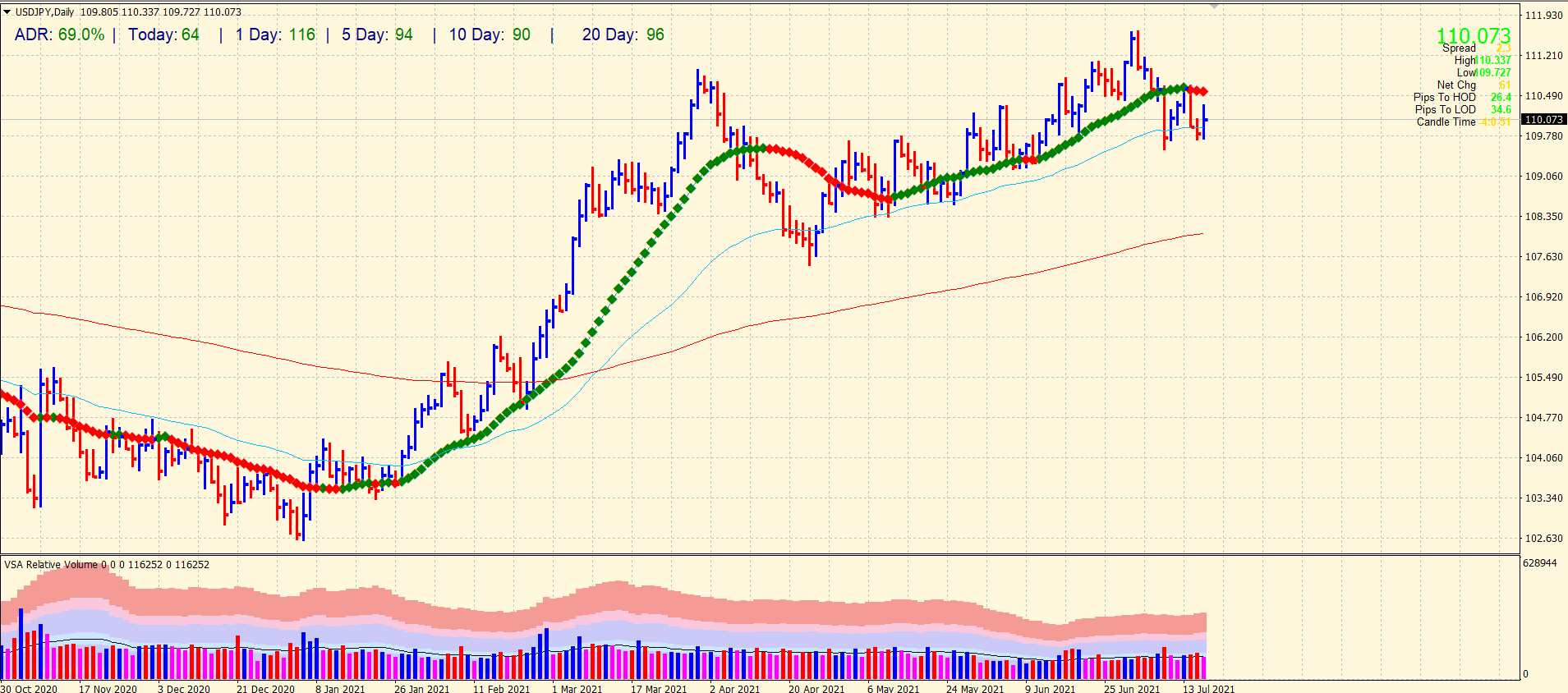

- Investors are looking for a technical breakout at 20-day or 50-day moving averages.

The USD/JPY weekly outlook remains mostly the same as it opened the week at 110.13 and closed at 110.07. This is because the Bank of Japan and Federal Reserve show no immediate change, while divergence in the path of both institutions is very obvious.

-Are you looking for forex options trading? Check out our detailed guide-

The Japanese central bank kept the base rate at 0.1% on Friday. The projected growth was revised from 4% to 3.8% for 2021. However, the Fed’s estimated growth for 2021 surged to 7% from the 6.5% forecast.

BOJ’s Kuroda said that the Japanese economy will slowly recover as the pandemic impact subsides and the vaccination process progresses. However, Fed Chair Powell kept shuffling his stance during his two days testimony at Capitol Hill.

Powell admitted no immediate path to change the monetary policy as inflation is way above the targets. However, he also said that the bank is actively considering the progress of the economy. The American producer price and consumer price indexes came up with too high figures than the forecast. Meanwhile, initial jobless claims were lower to a fresh pandemic low, and industrial production could gain half of the expected growth.

-Are you looking for a low spread forex broker? Check our detailed guide-

The most reassuring statistic of the week was US retail sales for June that came quite stronger than expected, but the negative revisions to all the categories of May had tempered the news. Consumer sentiment was quite soft, which can be considered as the initial impact of inflation.

What’s next to watch for USD/JPY outlook?

The next week has thin statistics for Japan and America. We expect a slight relief from deflation through the national CPI for Japan next week. US housing market is expected to show strong figures next week. However, both the events are not market movers.

The USD/JPY pair needs a substantial shift in the US interest rates to find a clear directional momentum. However, the bias still remains on the upside.

USD/JPY weekly technical outlook

The USD/JPY pair remains under the 20-day moving average, keeping it under selling pressure. However, the 50-day moving average is lending support to the pair. However, if the 50-day moving average breaks, we can see a deep decline to 108.00 (200-day moving average and an order block). The volume data is not clearly showing any directional bias at the moment. Hence, we can expect a ranging behavior for the time being. But 50-day and 20-day moving averages are key zones to look out for a breakout.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.