- USD/MXN extends recovery moves from 23.45 during early Asian session.

- The US extends non-essential travel restrictions on Canada, Mexico through June 22.

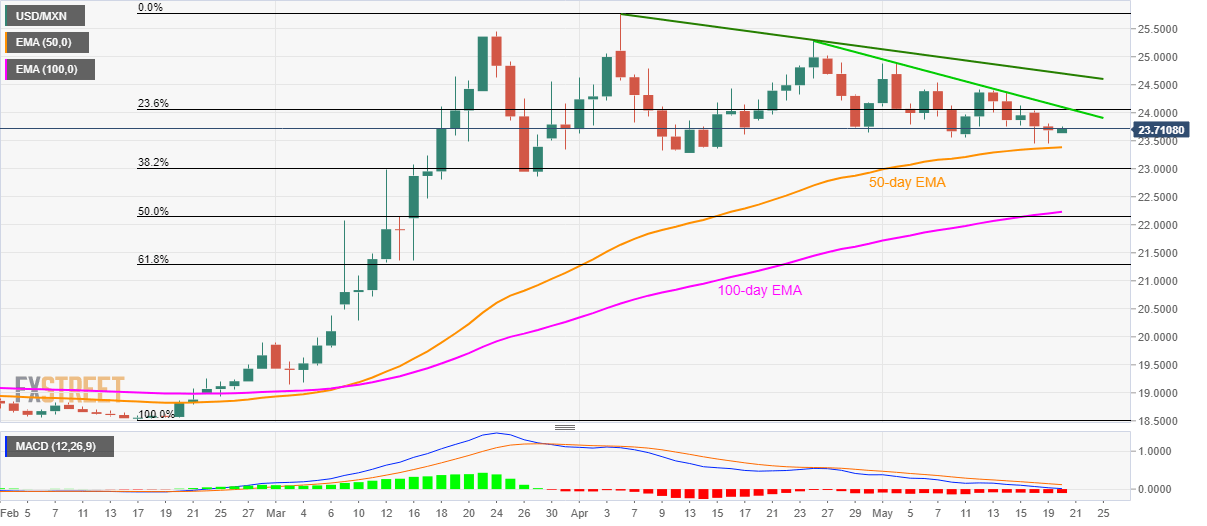

- Short-term falling trend line directs the quote toward 50-day EMA.

USD/MXN prints 0.30% gains while taking the bids near 23.71 during the initial Asian session on Wednesday. In doing so, the pair bounces off the lowest since April 15, 2020.

Extension of the non-essential travel restrictions by the US Department of Homeland Security (DHS) to borders with Canada and Mexico through June 22 seems to be the latest catalyst favoring the pair’s pullback.

However, a sustained trading below a falling trend line from April 24, at 24.10, keeps directing the quote towards a 50-day EMA level of 23.38.

In a case where bearish MACD exerts additional downside pressure below 23.38, April monthly low of 23.28 and March 27 bottom around 22.86 seems to regain the market’s attention.

On the upside, a clear break above 24.10 trend line resistance will escalate the pair’s recovery moves towards another descending trend line connecting highs marked so far in April month around 24.70.

USD/MXN daily chart

Trend: Pullback expected