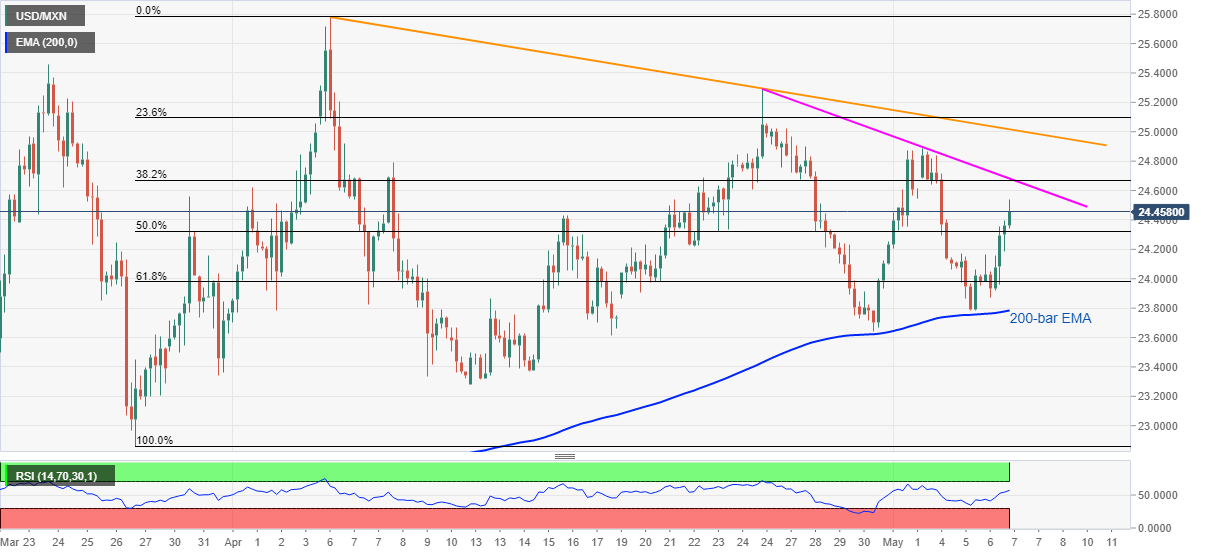

- USD/MXN extends pullback from the key EMA towards the weekly top.

- A fortnight-old falling trend line, monthly resistance line to check buyers.

- Sustained downside past-200-bar EMA can challenge April low.

USD/MXN takes the bids to 24.50, up 0.45% on a day, amid Thursday’s Asian session. That said, the quote currently trades near the highest in a week while extending the bounce off 200-bar EMA.

As a result, buyers can aim for a two-week-old falling resistance line, at 24.68, as the immediate target ahead of watching over the monthly trend line resistance of 25.01.

During the pair’s sustained trading past-25.01, April 24 top surrounding 25.30 and the previous month high close to 25.78 will be on the bulls’ radars.

Alternatively, 50% and 61.8% Fibonacci retracements of late-March to early-April rise, respectively around 24.32 and 23.98, can entertain sellers ahead of the key EMA.

It should, however, be noted that the pair’s declines below 200-bar EMA level of 23.78 will not hesitate to challenge April month low near 23.30.

USD/MXN four-hour chart

Trend: Further recovery expected