- USD/MXN bounces off short-term key support confluence.

- Mexican government warns of lack of doctors, also asks US/Canada to grant automakers transition for USMCA rules.

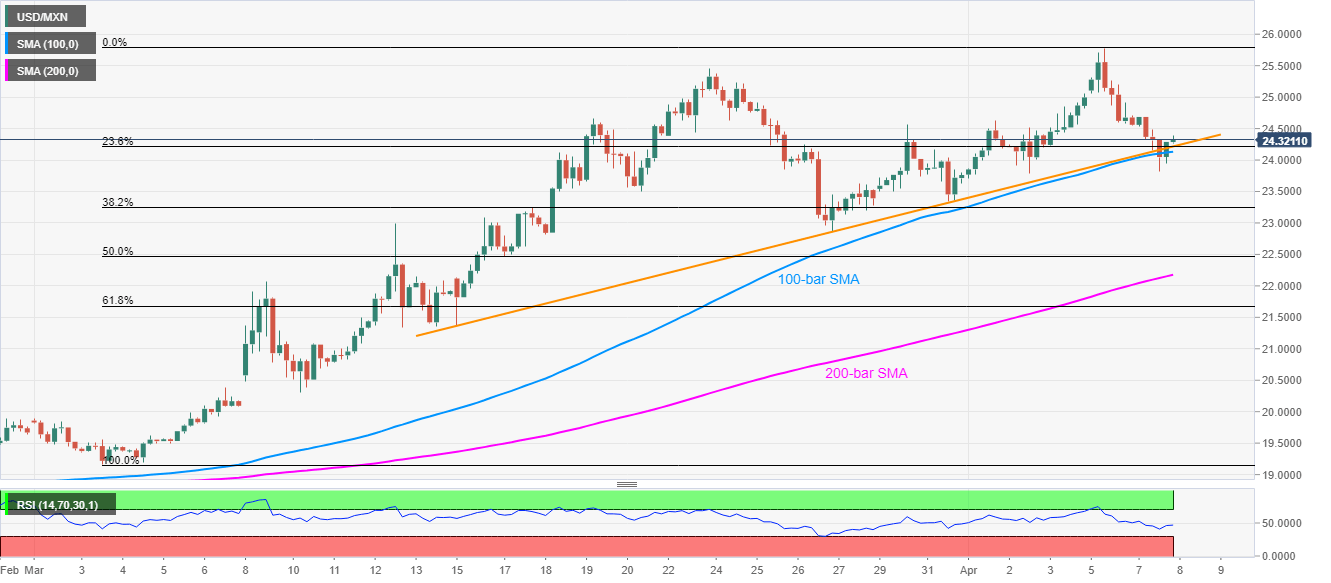

- 100-bar SMA, three-week-old rising trend line and 23.6% Fibonacci retracement limit immediate downside.

- March 23 high on buyers’ radars.

USD/MXN the bucks the previous two-day declines while rising 0.10% to 24.35 amid the Asian session on Wednesday. In doing so, the pair registers a U-turn from the confluence of 100-bar SMA, a short-term rising trend line and 23.6% Fibonacci retracement of its run-up from March 03 to April 06.

The Mexican peso could be taking clues from the Mexican government’s call for the lack of doctors, as cited by Reuters. Also supporting the pair could be the New York Times’ piece suggesting Mexico’s government on Tuesday asked the United States and Canada to grant its automotive industry extra time to adapt its supply chains as the deadline for implementing a new North American trade deal approaches.

Technically, the pair’s recent pullback from the key support confluence pushes it towards the late-March high surrounding 25.45, with 25.00 being an intermediate halt.

Though, any further upside past-25.45 might not hesitate to fresh the record top, marked last week, which stands near 25.80.

Meanwhile, the pair’s sustained declines below 24.20/10 support confluence could drag it to March 26 low near 22.85.

However, 200-bar SMA and 61.8% Fibonacci retracement could check the bears, respectively around 22.15 and 21.65, during the further downside.

USD/MXN forecast chart

Trend: Bullish