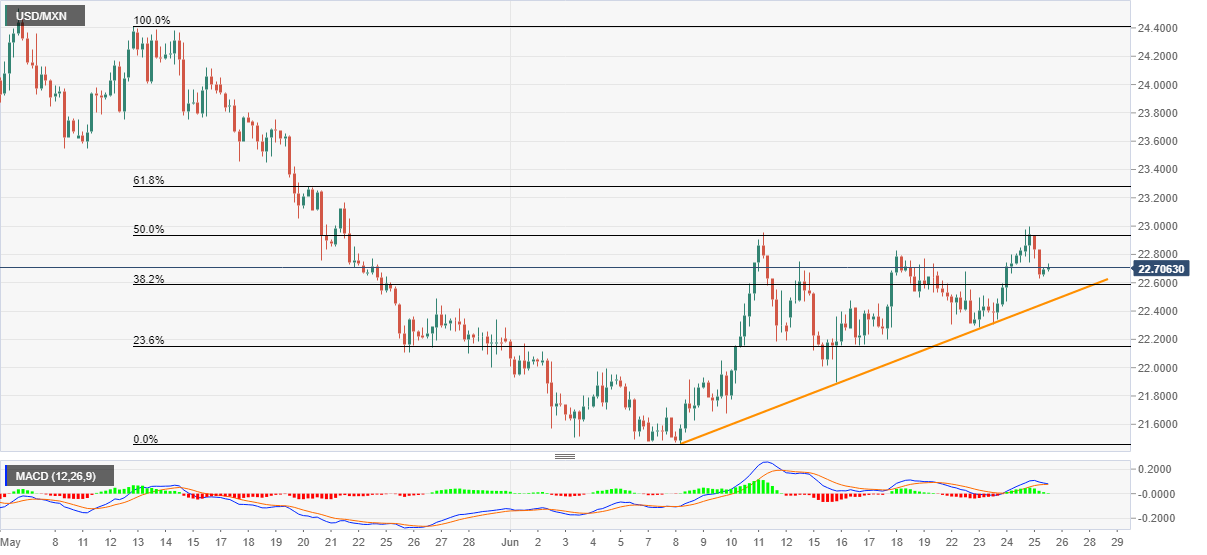

- USD/MXN extends recovery gains from 22.63 after the Mexican central bank announced a 0.50% rate cut.

- A 13-day-old support line keeps buyers hopeful.

- 50% of Fibonacci retracement offers immediate key resistance.

USD/MXN prints mild gains of 0.24% while taking the bids to 22.72 during the early Friday. The pair seems to extend the bounce off 22.63 after Banxico offered 50 basis points (bps) of rate cut the previous day.

However, 50% Fibonacci retracement of its fall from May 12 to June 09, at 22.93, remains untouched. Also acting as an immediate upside barrier could be June 18 top near 22.83 and the weekly high around 23.00.

In a case where the USD/MXN prices manage to cross 23.00 threshold on a daily closing basis, May 22 high near 23.16 and 61.8% Fibonacci retracement close to 23.30 might lure the optimists.

Alternatively, an ascending trend line from June 09, currently around 22.45, becomes near-time important support as it holds the gate for the pair’s further weakness towards 22.00 round-figure.

During the quote’s additional downside under 22.00, the monthly bottom adjacent to 21.46 will be in the spotlight.

USD/MXN four-hour chart

Trend: Further upside expected