- Emerging market currencies mixed against the US dollar, despite DXY slide.

- USD/MXN under the 20-day moving average, risks tilt to the downside.

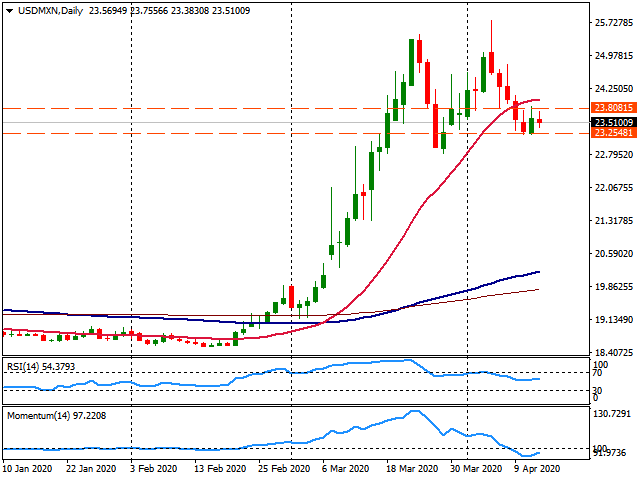

The USD/MXN moved sideways during Tuesday, around the 23.50. It peaked at 23.75 and then bottomed at 23.38, remaining inside Monday’s price range. The pair continues to consolidate, holding on to most of last week’s losses when it dropped from 25.60 to 23.25.

The Mexican peso failed to benefit from an improvement in market sentiment, partially offset by a sharp decline in crude oil prices. Near the end of the session, WTI is falling 8.50% not affecting equity prices in Wall Street. The Dow Jones is up 2.35% amid some optimism regarding the coronavirus pandemic.

Among emerging market currencies, the Polish zloty is so far the best performer followed by the Czech corona while on the flip side the South African rand lost more than 1%. The greenback dropped versus majors. The US Dollar Index reached the lowest in two weeks under 99.00, and it is falling by 0.40%.

Technical outlook

The short-term bias in USD/MXN is to the downside as long as it remains under the 20-day moving average (currently at 24.00) and the 23.80 zone. A break under 23.25 would clear the way for a slide of the pair to sub-23.00 levels.