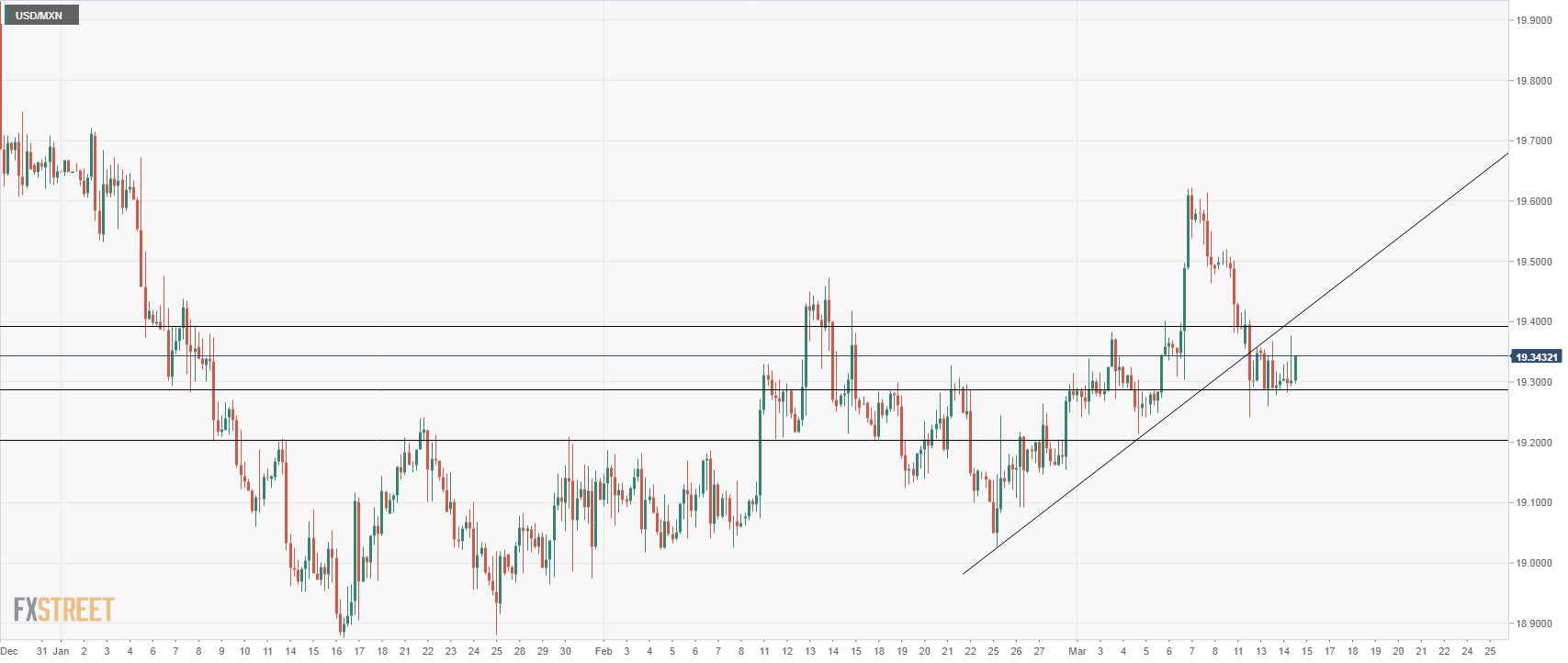

- The USD/MXN pair is rising today after falling during four days in-a-row on the back of a weaker US dollar. So far today, gains are limited and price remains above a key support level, supporting the bullish tone.

- To the downside, the area between 19.25 and 19.30 is a crucial support: 20-day moving average, uptrend line, and horizontal level. A daily close significantly below would clear the way to more losses and potentially to a test of 19.00 and the medium-term uptrend seen at 18.97.

- If the pair holds on top of 19.30, the bullish bias will remain in place. The US dollar needs to recover on top of 19.40 to gain momentum. The key resistance levels are seen at 19.45 and 19.60. Above 19.60 the next target is seen at 19.85.

USD/MXN Daily chart

USD/MXN 4 hour chart

Overview:

Today Last Price: 19.342

Today Daily change %: 0.30%

Today Daily Open: 19.2842

Trends:

Daily SMA20: 19.2809

Daily SMA50: 19.2013

Daily SMA100: 19.658

Daily SMA200: 19.4274

Levels:

Previous Daily High: 19.3673

Previous Daily Low: 19.2604

Previous Weekly High: 19.6225

Previous Weekly Low: 19.214

Previous Monthly High: 19.4726

Previous Monthly Low: 19.0168

Daily Fibonacci 38.2%: 19.3012

Daily Fibonacci 61.8%: 19.3265

Daily Pivot Point S1: 19.2406

Daily Pivot Point S2: 19.197

Daily Pivot Point S3: 19.1337

Daily Pivot Point R1: 19.3475

Daily Pivot Point R2: 19.4109

Daily Pivot Point R3: 19.4545

-636881838623186305.png)