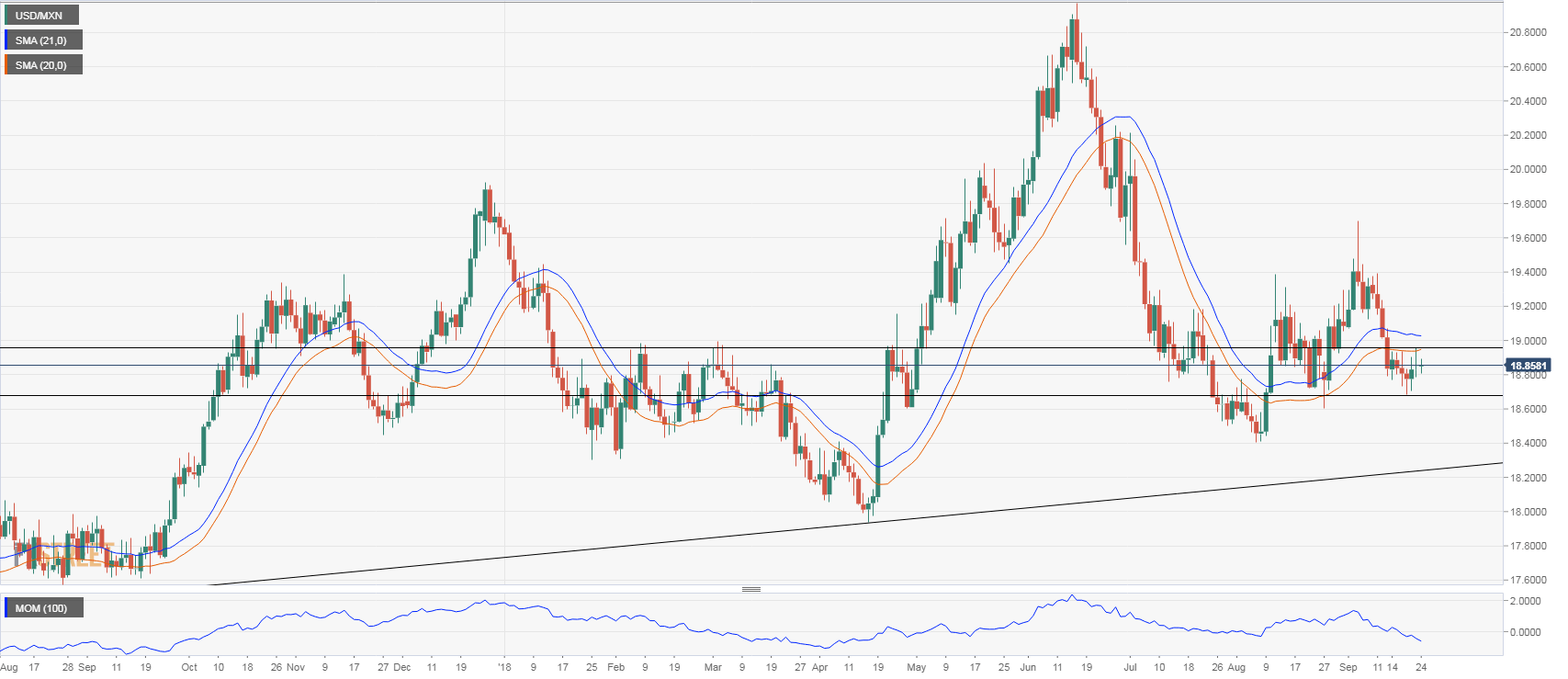

- The pair remained steady during the last sessions despite emerging markets rally. Mexican peso continues with a consolidation phase against US dollar, holding a mild bullish bias.

- USD/MXN continues to move sideways, near the 18.80 after the slide from 19.67 found support at the 18.70 area. The key resistance is seen around 18.90/95, the 20-day moving average. A daily close above would clear the way for a recovery above 19.00.

- On the flip side, the key short-term support continues to be the 18.70 zone: a break lower could open the doors for a slide to the 18.45/50 barrier.

USD/MXN Daily Chart

Spot: 18.85

Daily high: 18.87

Daily low: 18.80

Support Levels

S1: 18.80

S2: 18.70

S3: 18.50

Resistance Levels

R1: 18.95

R2: 19.15

R3: 19.30