- The Russian currency keeps appreciating, targets 64.00.

- Industrial Production in Russia expanded more than expected.

- Russia’s Producer Prices coming up next on the docket.

The upbeat momentum in the Russian Ruble remains unabated so far this week, forcing USD/RUB to recede to the area of 2019 lows in the vicinity of the 64.00 handle, levels last seen in early August 2018.

USD/RUB weaker on USD-selling, risk-on

RUB keeps gathering traction on Tuesday, extending the up move for the second consecutive week to levels near 64.00 the figure, or fresh 7-month highs vs. the buck.

RUB is picking up pace on the back of the continuation of the better mood in the EM FX space in combination with the persistent offered bias surrounding the greenback.

The positive sentiment in crude oil prices is also lending extra oxygen to RUB, with the European reference Brent crude is navigating fresh yearly highs beyond the $68.00 mark per barrel at the time of writing.

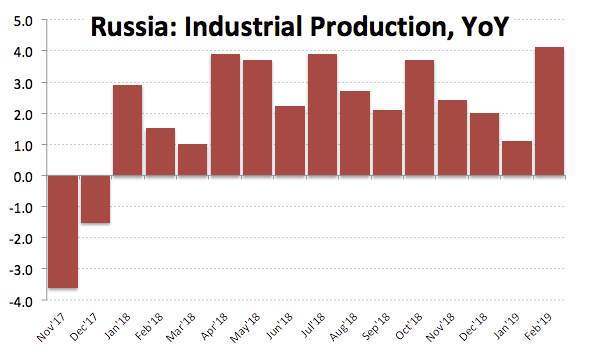

Adding to RUB sentiment, Industrial Production in Russia expanded 4.1% on a year to February (Monday), while Producer Prices are due later seconded by Retail Sales and the unemployment rate tomorrow, the CBR FX reserves on Thursday and the CBR meeting on Friday.

Later in the session, US Factory Orders will be the sole release ahead of the FOMC meeting tomorrow.

What to look for around RUB

The ongoing moderate trend in inflation figure plus the economy expanding above estimates could prevent the CBR from hiking rates further in the near/medium term. The central bank sees inflation picking up pace in the next months, although consumer prices should drift to the bank’s 4% target at some point in H1 2020. That said, it appears the ‘pause mode’ in the CBR could be in place for longer than expected. Furthermore, the carry-trade remains supportive of RUB along with expected higher oil prices (despite RUB seems to have decoupled from oil dynamics as of late). On the negative side, the spectre of further sanctions on Russian citizens or the economy as well as geopolitical jitters carries the potential to undermine occasional upside momentum in RUB.

USD/RUB levels to watch

At the moment the pair is retreating 0.06% at 64.30 and faces the next support at 64.13 (2019 low Mar.18) followed by 62.73 (200-week SMA) and finally 61.63 (monthly low Jul.10 2018). On the other hand, a breakout of 65.81 (55-day SMA) would open the door to 66.52 (200-day SMA) and then 67.16 (high Feb.14).