- The Russian currency loses further ground today.

- Spot moves higher and retakes the 66.00 mark.

- Russian CPI rose 5.2% YoY in February.

USD/RUB is extending the march north in the second half of the week, retaking the critical 66.00 mark and testing at the same time the area of 2-month peaks.

USD/RUB now targets the 200-day SMA

The pair is up for the third session in a row so far today, gathering extra traction following weekly lows in the mid-65.00s recorded on Tuesday.

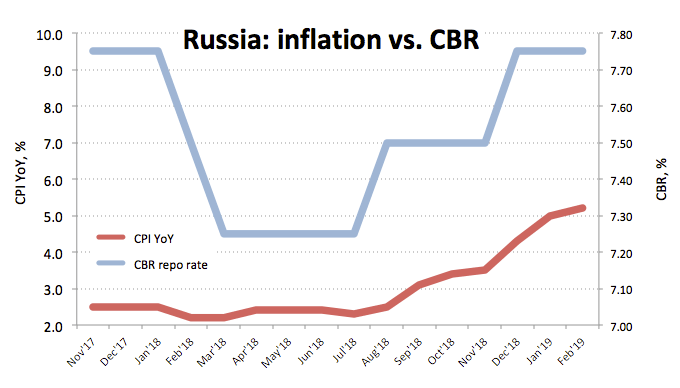

RUB is depreciating further after Russian inflation figures matched expectations in February, rising at an annualized 5.2% (from 5.0%) and 0.4% inter-month (from 1.0%). These higher inflation figures were mainly on the back of rising food prices while the raise in the VAT seems to have also collaborated. The central bank, however, expects the effects of the raise in the VAT to last until April.

Furthermore, this uptick in consumer prices falls in line with the projected inflation from the CBR, estimated to fluctuate between 5%-5.5% bye year-end, while recent GDP figures showed the economy is running above the bank’s projection.

What to look for around RUB

The ongoing moderate trend in inflation figure plus the economy expanding above estimates could prevent the CBR from hiking rates further in the near/medium term. The central bank sees inflation picking up pace in the next months, although consumer prices should drift to the bank’s 4% target at some point in H1 2020. That said, it appears the ‘pause mode’ in the CBR could be in place for longer than expected. Furthermore, the carry-trade remains supportive of RUB along with expected higher oil prices (despite RUB seems to have decoupled from oil dynamics as of late). On the negative side, the spectre of further sanctions on Russian citizens or the economy as well as geopolitical jitters carries the potential to undermine occasional upside momentum in RUB.

USD/RUB levels to watch

At the moment the pair is advancing 0.07% at 65.99 and a breakout of 66.16 (55-day SMA) would open the door to 66.41 (200-day SMA) and then 67.16 (high Feb.14). On the flip side, the initial support emerges at 65.80 (10-day SMA) followed by 65.51 (low Mar.5) and finally 65.16 (2019 low Jan.31).