Nearly two months have passed since Donald Trump was elected and two weeks remain until the inauguration. The result has boosted the greenback, but what’s next?

Here is their view, courtesy of eFXnews:

2016 was a roller-coaster for markets. A year ago investors were in panic about deflation. Back then, we took a contrarian view and argued that inflation was what could really surprise markets (Prepare to fight the central banks). Indeed, as the year progressed, a good case inflation scenario unfolded. Before the US elections, we argued that the good reflation scenario would continue, despite substantial risks (The rest of the year ahead and a preview of the year to follow). The market reaction following the US elections was even faster than we had expected. Having been right too early, we are now wondering what could surprise markets this year.

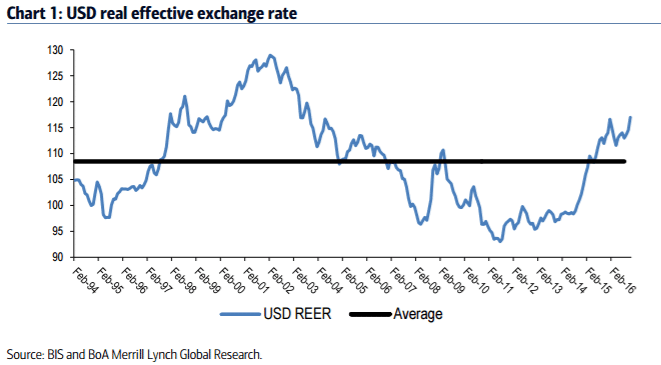

Markets could prove to be right and the USD could strengthen further. In real effective terms, the USD is about 8% above its 20-year average, but still 8% below its high of 2002. Although hedge funds are long the USD, real money remains short, relatively to positioning in the last 12 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

We forecast USD/JPY at 120 and EUR/USD at 1.02 in 2017, but the risks are for an even higher USD in a positive scenario.

We remain bullish on the USD for the year, but see short-term risks…We have been arguing for EUR/JPY upside since September, as we believe that the BoJ has more credibility in easing monetary policy than the ECB. Assuming no tail risks in Europe, we like SEK, particularly against CHF. We stick to our contrarian year-ahead short EUR/GBP trade.