- USD/TRY accelerates the upside to the 8.15 area.

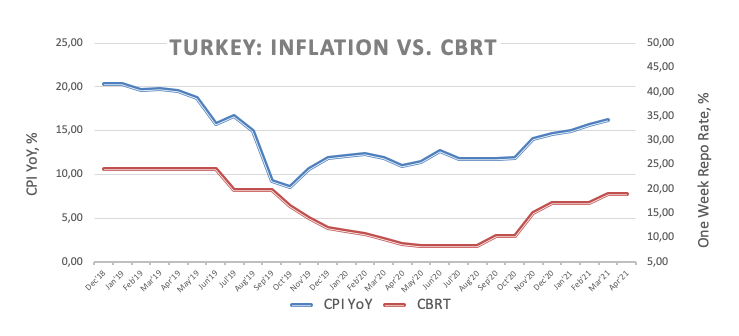

- The CBRT left the One-Week Repo rate unchanged at 19.00%.

- The central bank dropped the commitment to keep a tight stance.

The Turkish lira reverses the recent strength and now pushes USD/TRY to daily tops near 8.1500.

USD/TRY up following steady CBRT

USD/TRY resumes the upside following three daily pullbacks in a row and after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 19.00% at its meeting on Thursday.

The central bank noted that inflation expectations remain at elevated levels and pose risks to the inflation outlook, although it kept the 5% medium-term target unchanged. Further selling pressure around the lira comes after the CBRT removed its pledge to keep the tightening stance from the statement, noting that the key rate will be set above the inflation rate.

Earlier in the week, Turkey’s jobless rate ticked higher to 13.4% and the Current Account deficit widened to $2.61 billion in February. On a brighter side, Industrial Production expanded 8.8% on a year to February and Retail Sales expanded 3.4% from a month earlier also in February.

What to look for around TRY

The near-term outlook for the lira remains fragile to say the least. Despite keeping rates unchanged at Thursday’s meeting, Governor S.Kavcioglu is gradually expected to reverse (wipe out) the shift to a market friendly approach of the monetary policy that was successfully implemented by former Governor N.Agbal back in November 2020. Against this, it will surprise nobody to see the CBRT returning to the unorthodox/looser monetary stance in the next months, opening the door to further lira depreciation, FX reserves exodus and rising bets on a Balance of Payment crisis.

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Capital controls? The IMF could step in to bring in financial assistance.

USD/TRY key levels

At the moment the pair is advancing 0.82% at 8.1199 and faces the next up barrier at 8.2231 (weekly high Apr.12) followed by 8.4526 (2021 high Mar.30) and then 8.5777 (all-time high Nov.6 2020). On the other hand, a drop below 7.9843 (monthly low Apr.2) would aim for 7.5417 (200-day SMA) and then 7.1856 (monthly low Mar.19).