- USD/TRY trades on the defensive near 5.80.

- Q2 GDP contracted less than expected.

- Manufacturing PMI extends the recovery.

The Turkish Lira is gaining further upside momentum at the beginning of the week and is now dragging USD/TRY to the 5.80 area.

USD/TRY weaker on data despite USD-buying

TRY is extending the correction lower from the recent rejection of the 5.85 area, where sits a Fibo retracement of the May-August drop. Today’s lows in sub-5.80 area also coincide with the 100-day and 10-day SMAs.

The Lira’s better performance today comes in despite the solid note in the Greenback and in response to upbeat results from the domestic docket.

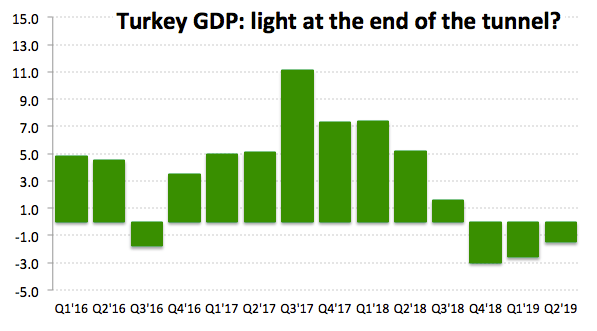

In fact, the manufacturing PMI improved to 48.00 in August (from 46.70), while GDP figures showed the economy contracted at an annualized 1.5% during the April-June period, less than forecasted.

In light of the recent GDP figures, the agricultural sector increased by 3.4% its total value added, went down 2.7% and 12.7% in the industry sector and construction sector, respectively and decreased 0.3% in the services industry.

Looking ahead, key inflation figures are due tomorrow along with Producer Prices and ahead of Friday’s Treasury Cash Balance results.

What to look for around TRY

The current preference for safer assets in response to the US-China trade war and fears of a technical recession at some point in the next couple of years in the US has undermined extra gains in the Lira. On another front, newly appointed Governor M.Uysal appears to have inaugurated an Erdogan-sponsored easing cycle following the interest rate cut by the CBRT earlier this month. Further moves from the CBRT included the reduction of the RRR in order to boost banks’ lending and give extra oxygen to the economy. In the longer run, however, TRY looks supported by the ‘hunt for yield’, as domestic rates still look attractive in spite of the recent cut. On the more macro view, the country needs to implement the much-needed structural reforms (announced in April) to bring in more stability to the currency and sustain a serious recovery in both economic activity and credibility.

USD/TRY key levels

At the moment the pair is losing 0.28% at 5.8149 and faces the next support at 5.7536 (38.2% Fibo of the May-August drop) seconded by 5.6791 (55-day SMA) and then 5.5847 (200-day SMA). On the upside, a surpass of 5.9416 (61.8% Fibo of the May-August drop) would expose 6.0027 (‘flash crash’ Aug.26) and finally 6.1516 (high May 23).