- The Turkish Lira depreciates once again and tests highs around 5.40.

- Turkey inflation figures came in below expectations in February.

- CBRT seen ‘on hold’ at its meeting on Wednesday.

USD/TRY keeps the march north unabated so far on Monday and is now gyrating around the key 200-day SMA in the 5.40 region.

USD/TRY stronger post-CPI, looks to CBRT

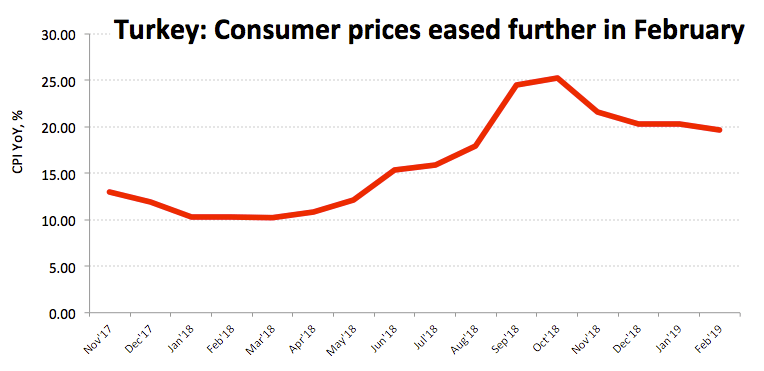

The pair gained further upside pressure today after inflation figures in Turkey came in below estimates for the month of February. In fact, consumer prices rose 19.67% from a year earlier and 0.16% inter-month.

Additionally, Producer Prices rose 29.59 over the last twelve months and 0.09% on a monthly basis.

In the meantime, TRY remains well under pressure as economic recession is poised to persist for the time being against the backdrop of still high inflation figures and the omnipresent effervescence between the central bank and the Erdogan administration, all ahead of the imminent municipal elections.

What to look for around TRY

TRY continues to lose ground albeit at a gradual pace since 2019 highs seen at the beginning of February (around 5.16), as market participants continue to adjust to the potential effects of the continuation of the Fed’s tightening cycle on the EM FX universe. Furthermore, the persistent deterioration in domestic fundamentals, the permanent conflict between Erdogan’s government and the central bank and potential geopolitical risks should continue to weigh on the currency for the time being. The next risk event in Turkey will be the local elections at the end of the month, where the economic situation is expected to drive the sentiment among voters.

USD/TRY key levels

At the moment the pair is gaining 0.54% at 5.3830 facing the next hurdle at 5.4544 (monthly high Dec.5 2018) seconded by 5.5440 (high Jan.9) and finally 5.6371 (2019 high Jan.3). On the downside, a breach of 5.2874 (low Feb.27) would expose 5.2856 (21-day SMA) and then 5.1594 (2019 low Jan.31).