- USD/TRY rebounds to test the 21-DMA support-turned-resistance.

- The CBRT leaves the policy rate unchanged 19% on Thursday, as expected.

- The spot remains in familiar range ahead of the US data.

USD/TRY looks to extend the bounce above the $8 mark, snapping a four-day losing streak, as the US dollar sell-off stalls across the board.

Meanwhile, the Turkish lira is trying to defend the Central Bank of the Republic of Turkey (CBRT) monetary policy decision-induced gains.

The spot hit two-day highs at $8.16 after the Turkish central bank held the rates steady at 19% while refrained from reiterating last month’s pledge to “decisively” maintain a tight policy.

Looking ahead, the spot will continue to remain at the mercy of the USD dynamics, as the dust settles over the CBRT aftermath. The focus shifts towards US Consumer Sentiment data for fresh trading impetus.

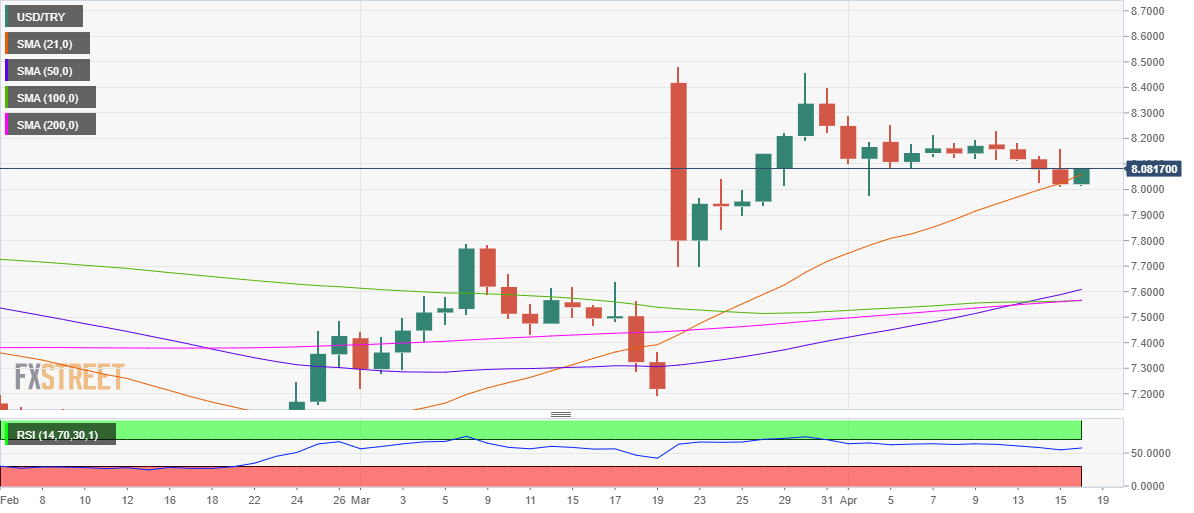

USD/TRY: Daily chart

At the time of writing, the price has managed to recapture the 21-daily moving average (DMA) at $8.06, the previous strong support now resistance.

A daily closing above that level could unleash additional recovery momentum, calling for a test of Thursday’s high of $8.16.

Further up, the $8.20 round number could be challenged. The Relative Strength Index (RSI) edges higher above the midline, reflective of more gains.

The golden cross confirmed on the said time frame earlier this week, also adds credence to a potential rebound in USD/TRY.

The golden cross appears on a chart when a 50-DMA crosses above the 200-DMA, which indicates a bull market on the horizon and is reinforced by high trading volumes, per Investopedia.

Alternatively, USD/TRY could drop to test the powerful support around the $7.57 region, which is the intersection of the 50, 100 and 200-DMAs.