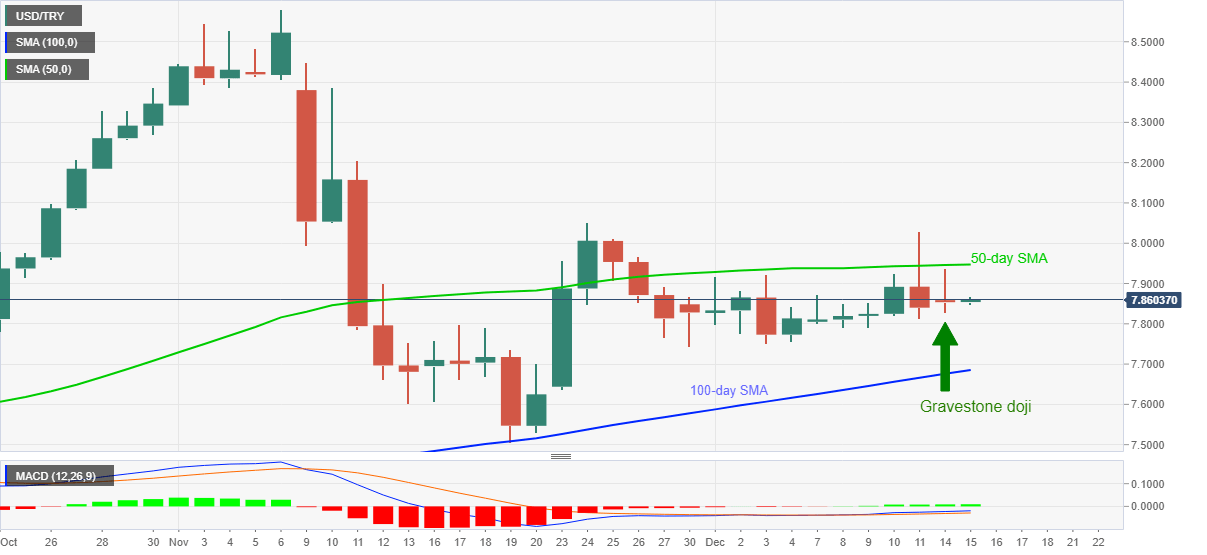

- USD/TRY snaps two-day weakness despite stays below 50-day SMA.

- Bullish candlestick formation joins upbeat MACD signals to favor the buyers.

- Sellers need to conquer 100-day SMA for entries.

USD/TRY seesaws near the intraday high of 7.8671, currently around 7.8581, during the early Tuesday. The pair marked another daily closing below 50-day SMA but flashed gravestone doji candlestick formation on D1 play the previous day.

The likely upside momentum gains clues from the quote’s sustained trading beyond 100-day SMA and bullish MACD.

However, a successful break above 50-day SMA, at 7.9475 now, becomes necessary to recall the bull targeting the late-November top near 8.0510.

Meanwhile, USD/TRY sellers need to refresh the monthly bottom near 7.7520 before targeting the 100-day SMA level of 7.6850.

Overall, the quote gradually gains the upside momentum and hence bears should remain cautious.

USD/TRY daily chart

Trend: Further upside expected