- USD/TRY looks south as bearish sentiment around TRY has weakened.

- Turkey’s third quarter GDP may show a strong rebound in output.

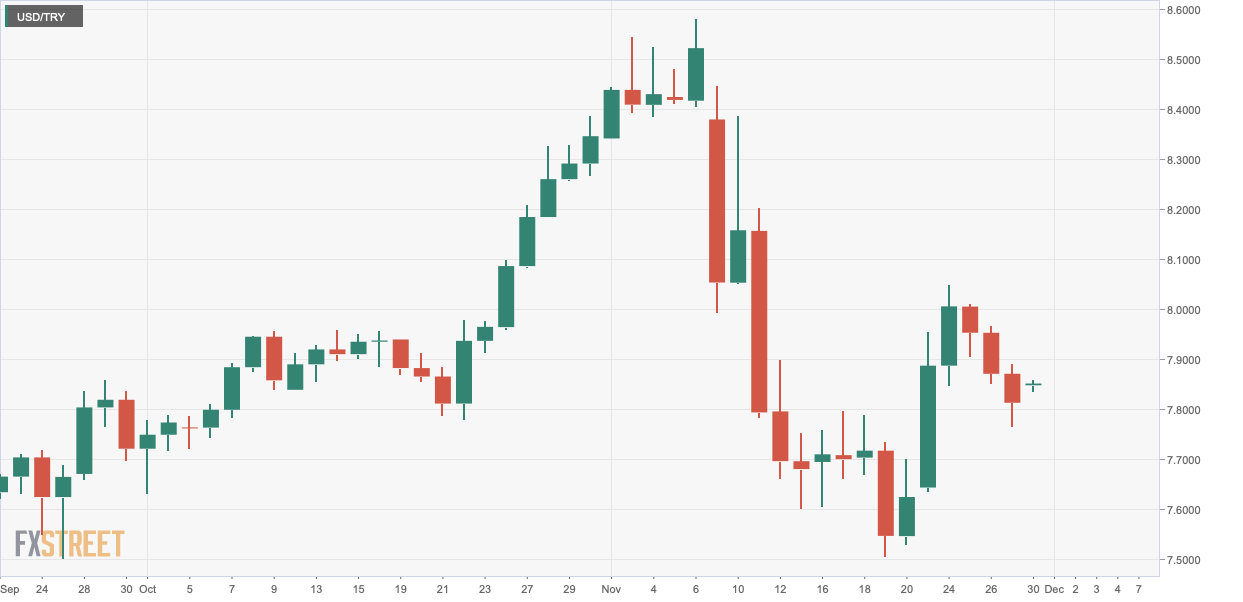

Turkish Lira (TRY) rose for the third straight day on Friday, reinforcing the bearish view put forward by the bearish inside candlestick pattern confirmed on Nov. 26.

The bearish setup is backed by a below-50 reading on the 14-day Relative Strength Index. As such, a deeper decline could be in the offing.

The sentiment around the lira was too bearish until a few weeks ago. However, that has recently changed, with many saying that the battered currency has bottomed out, as noted by Robin Brooks, Chief Economist at the Institute of International Finance (IIF).

The recent rate hike by Turkey’s central bank, coronavirus vaccine optimism, and other policy changes initiated by the government look to have turned the tide in favor of the TRY.

Turkey’s real gross domestic product for the third quarter will be released on Monday. According to Brooks, high-frequency indicators point to a strong rebound in output growth in the July-September period, which should keep Turkey’s full-year real growth close to zero in 2020, far above other emerging economies. A big beat on expectations may accelerate TRY’s rally.

Daily chart

Trend: Bearish

Technical levels

Resistance: 7.9127 (50-day SMA), 8.0423 (Nov. 24 high)

Support: 7.76 (Friday’s low), 7.5662 (200-day SMA)