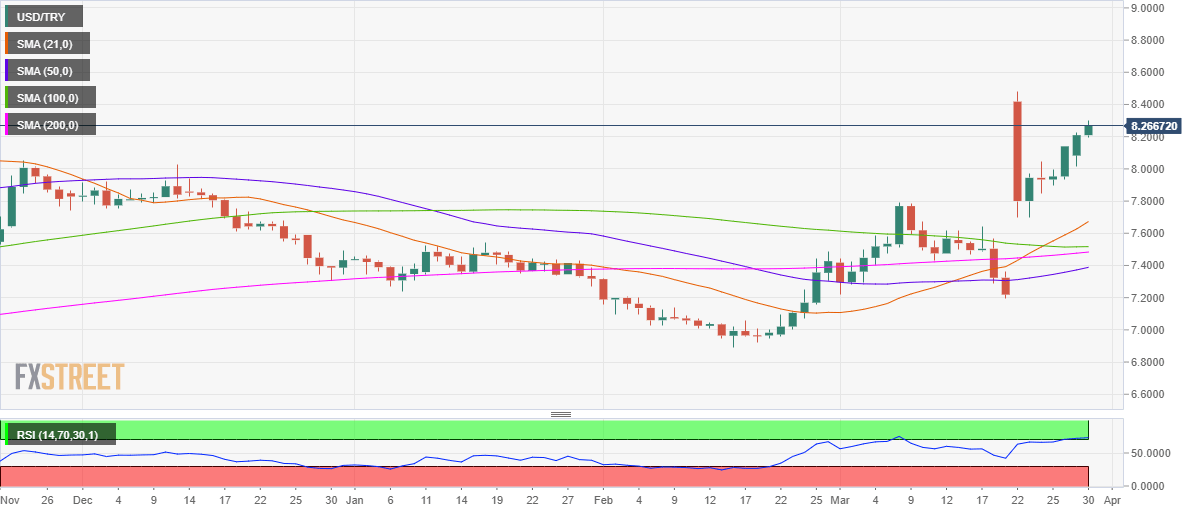

- USD/TRY extends towards multi-month highs above 8.20.

- US rates rise, Turkish central bank shake-up once again offer support.

- RSI stays in the overbought zone on the 1D chart, a pullback likely?

USD/TRY is extending its three-day winning streak into Tuesday, with the latest leg higher supported by a fresh shake-up in the Turkish central bank, which exacerbated the pain in the lira.

Turkey’s President Recep Tayyip Erdogan fired the Deputy Governor of the central bank, less than two weeks after he dismissed the CBRT Chief.

The central bank upheaval left investors fretting over its implications on the financial markets. The latest action only implies that Turkey may return to unorthodox economic policies, including imposing capital controls to protect its currency.

On the USD-side of the equation, the US dollar index holds onto the recent gains on rising Treasury yields, as investors remain hopeful amid vaccine progress ahead of Wednesday’s President Joe Biden’s $3+ trillion infrastructure stimulus roll out.

From a near-term technical perspective, the spot remains at risk of a pullback, given that the 14-day Relative Strength Index (RSI) on the daily chart trades within the overbought conditions.

USD/TRY: Daily chart

Should the reversal occur a test of the 8.00 level could be on the cards. Meanwhile to the upside, the spot can retest the multi-month highs at 8.4836.