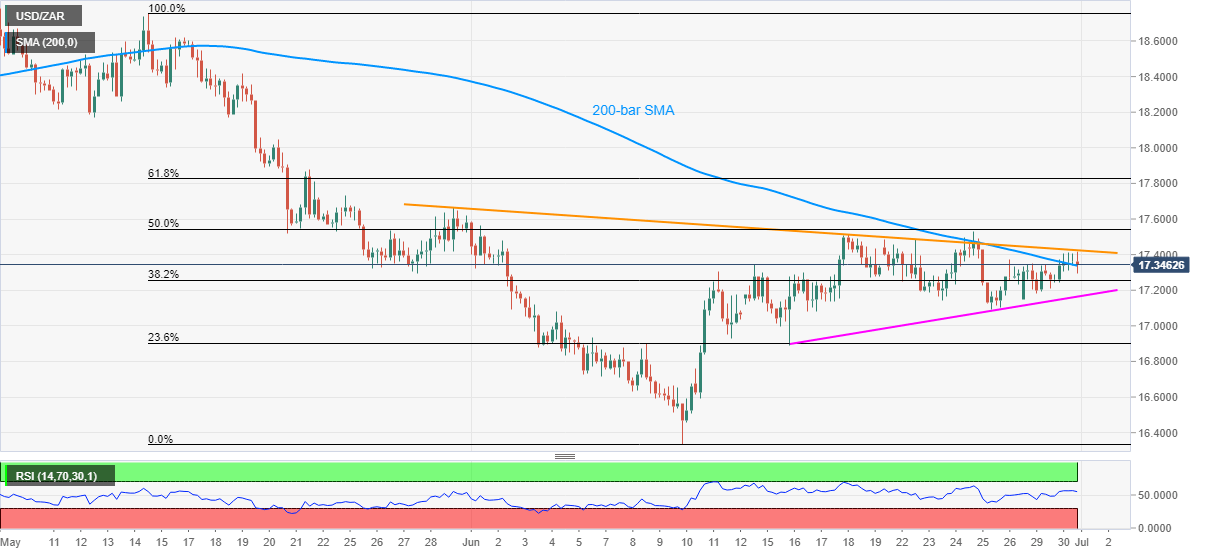

- USD/ZAR struggles to keep the three-day winning streak.

- 200-bar SMA, monthly resistance line challenge the pair’s further upside.

- A two-week-old ascending trend line restricts immediate declines.

USD/ZAR seesaws around 17.35 during Wednesday’s Asian session. The quote rose for the consecutive three-day to Tuesday. Though, key upside barriers question the pair’s additional north-run.

Even so, normal RSI conditions and an upward-sloping support line from June 16 portrays the bulls’ hold on the momentum.

As a result, the USD/ZAR traders will keep eyes on the upside break of 17.43 for extending the recent run-up towards 50% Fibonacci retracement of May-June fall, around 17.55.

In a case where the buyers remain dominant past-17.55, May 29 high of 17.67 and 61.8% of Fibonacci retracement at 17.83 might entertain the optimists ahead of 18.00 round-figure.

On the contrary, the pair’s pullback moves might aim to conquer the immediate support line, at 17.16 now, ahead of targeting a move towards 17.00 threshold and June 09 high near 16.90.

If at all the sellers keep the helm below 16.90, the previous month’s low of 16.34 will pop-up on their radars.

USD/ZAR four-hour chart

Trend: Pullback expected