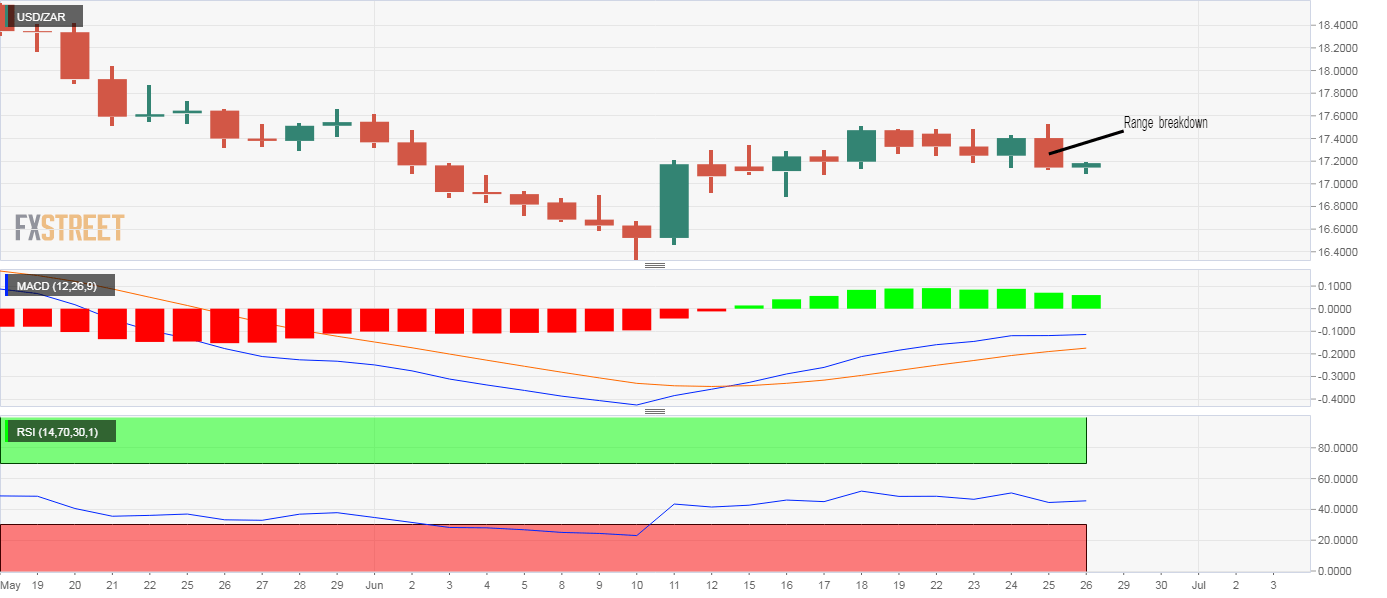

- USD/ZAR looks south with a range breakdown on the daily chart.

- Key indicators favor a test of deeper support levels.

USD/ZAR is trading at 17.1773 at press time, representing a 0.30% gain on the day.

The bounce could be short-lived, as the daily chart studies are reporting bearish conditions. To start with, Thursday’s 1.34% decline, the biggest single-day decline since May 21, confirmed a downside break of the narrow trading range of 17.1670-17.50.

The range breakdown suggests the bounce from the June 10 low of 16.3204 has ended and the bears have regained control. In addition, the 14-day relative strength index is hovering in bearish territory below 50 and the MACD histogram is beginning to chart lower bars above the zero line, a sign of weakening of upward momentum.

The pair risks falling to the psychological support of 17.00, which, if breached, would shift the focus to 16.3204. A close above Thursday’s high of 17.5303 is needed to restore the bullish view.

Daily chart

Trend: Bearish