The Canadian dollar suffered from oil prices and is a clear “risk” currency. The yen is the ultimate “safe haven” and the euro is usually a safe haven, but not exclusively. And what do the charts say? Here are the views from SocGen:

Here is their view, courtesy of eFXnews:

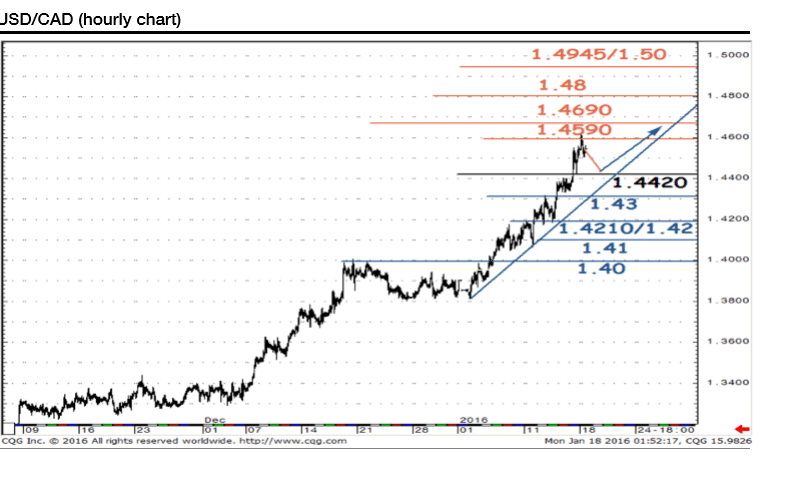

In an accelerated up move, USD/CAD has achieved its advocated target of 1.45 after breaching above a massive upward channel, notes SocGen Techs.

“In the process the pair has confirmed a double bottom and has crossed above ultimate retracement level (76.4% at 1.45) of 2002-2007 down move. Projected target for the pattern stands at 1.59/1.62 which also corresponds with 2002 highs.

If we drop down to daily chart, the pair has broken above a multi month ascending channel which points towards continuation in up move. The pair is likely to head higher initially towards 1.4690 with next target 1.4945/1.50, a projection for the up move. Monthly RSI is now testing a graphical ceiling which suggests possibility of retracement once 1.4945/1.50 levels are achieved.

Short term pullback is likely to be cushioned at 1.42 while multiyear channel at 1.38/1.3760 will be a key support,” SocGen projects.

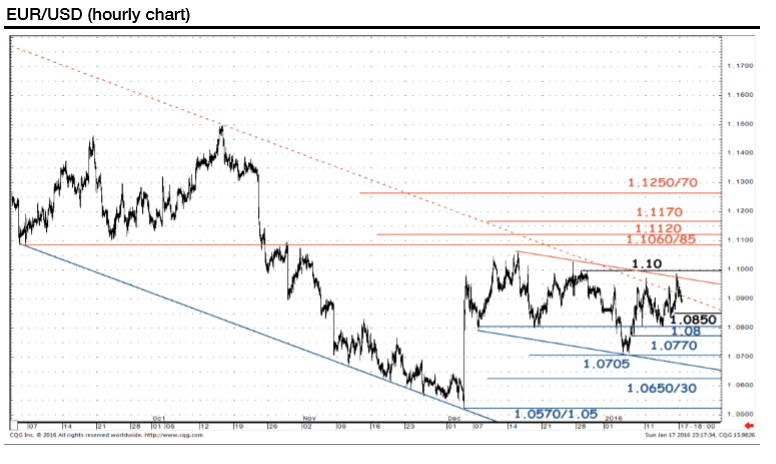

Turning to EUR/UD, SocGen thinks that a break above the short term descending channel limit around 1.1060/85 would decide if the current recovery extends.

“EUR/USD has been tracing a H&S at pivotal support of 1.05, confluence of multi-decade channel and down sloping one since 08.

The pair faced resistance at highs of March’15 at 1.1060/85 where it is forming the right shoulder of a H&S. Only a move above will indicate possibility of further rebound,” SocGen adds.

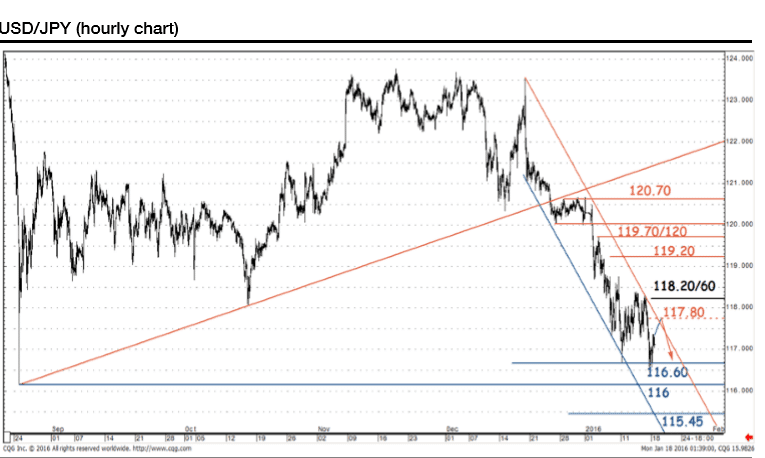

Fianlly in USD/JPY, SocGen thinks that the pair is approaching towards neckline of weekly H&S pattern around 116.

“After facing resistance at multiyear trend (126), USD/JPY is evolving within a H&S formation. The pair recently violated multi month channel and is approaching towards neckline at 116.

A break below will confirm a deeper correction towards September 2014 highs of 110 with intermittent target at 114. 123.70 should cap upside,” SocGen argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.